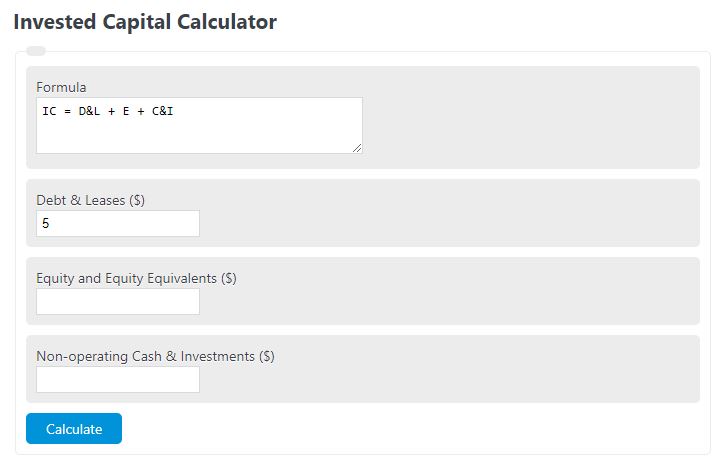

Enter the total debt & leases, total equity & equity equivalents, and non-operating cash and investments to determine the total invested capital.

Invested Capital Formula

The following formula can be used to calculate the total invested capital.

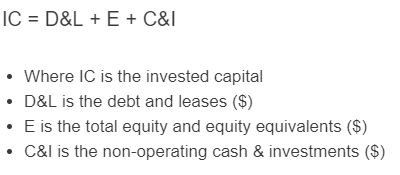

IC = D&L + E + C&I

- Where IC is the invested capital

- D&L is the debt and leases ($)

- E is the total equity and equity equivalents ($)

- C&I is the non-operating cash & investments ($)

Debt and leases refer to financial obligations where an entity borrows money or acquires assets through lease agreements, respectively.

Total equity and equity equivalents refer to the combined value of a company’s common stock, preferred stock, and other financial instruments that can be easily converted into equity shares.

Non-operating cash and investments refer to the funds and financial assets held by a company that is not directly related to its core business operations.

Invested Capital Definition

Invested capital refers to the total amount of money that a company has invested in its operations. It includes both equity and debt financing. Equity financing represents the funds shareholders provide, while debt financing includes loans and other forms of borrowed capital.

Invested capital is crucial for several reasons. Firstly, it forms the foundation of a company’s financial structure, enabling it to acquire assets and finance its ongoing operations. By investing capital, a company can purchase equipment, machinery, and other resources necessary for production. This capital also helps cover initial expenses, such as research and development costs or marketing campaigns.

Secondly, invested capital plays a significant role in determining a company’s profitability and return on investment. By analyzing the return on invested capital (ROIC), investors and analysts can assess the efficiency and effectiveness of a company’s capital allocation. A higher ROIC indicates that a company is generating more profits from its invested capital, which is a positive indicator of financial performance.

Invested capital is also important when considering the cost of capital. The cost of capital refers to the rate of return required by investors to invest in a company. It is influenced by the mix of equity and debt financing in a company’s capital structure. By understanding the cost of capital, a company can make informed decisions regarding its capital-raising strategies, such as issuing new shares or obtaining loans.

What is included in invested capital?

The following factors are included in invested capital:

- Debt and Leases. This is any long or short-term debt owned by an individual.

- Equity. This includes all equity and equity equivalents.

- Non-operating cash. This is any cash that is readily liquid and available to use.

- Investments. This includes any investment, even those done through margin.

Can an invested capital be negative?

An invested capital should not be negative if calculated correctly, however, the return on an invested capital can most certainly be negative if the invested capital decrease over time.

Invested Capital Example

How to calculate invested capital?

- First, determine the total debt and leases.

This will be the total debt and leases used on equipment and services directly used for the business.

- Next, determine the total equity.

Evaluate the total value of the equity and equity equivalents.

- Next, determine the non-operating cash and investments.

Evaluate the total amount of non-operating cash and investments.

- Finally, calculate the invested capital.

Using the formula, calculate the total amount of invested capital.

FAQ

Invested capital is a financial term used to describe the total amount of monetary capital invested in any given business or business segment.

These are included in invested capital because while they are liabilities, they are part of the total investment in the project.