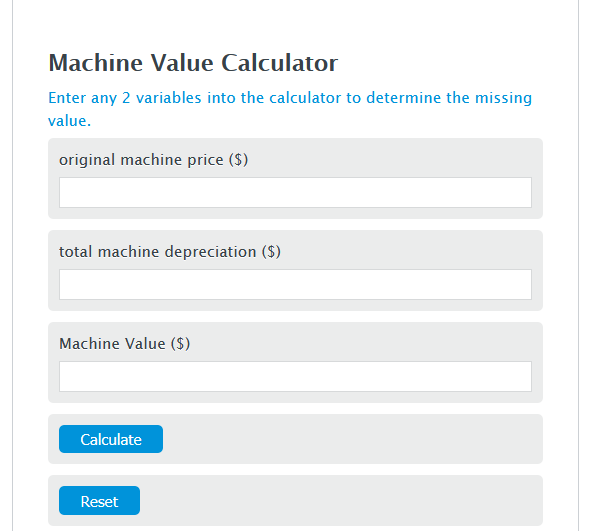

Enter the original machine price ($) and the total machine depreciation ($) into the Calculator. The calculator will evaluate the Machine Value.

Machine Value Formula

MV = OP - D

Variables:

- MV is the Machine Value ($)

- OP is the original machine price ($)

- D is the total machine depreciation ($)

To calculate Machine Value, subtract the total machine depreciation from the original machine price.

How to Calculate Machine Value?

The following steps outline how to calculate the Machine Value.

- First, determine the original machine price ($).

- Next, determine the total machine depreciation ($).

- Next, gather the formula from above = MV = OP – D.

- Finally, calculate the Machine Value.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

original machine price ($) = 3000

total machine depreciation ($) = 2000

FAQs

What is machine depreciation?

Machine depreciation is the process of allocating the cost of a physical asset over its useful life. It represents the decrease in value of the machinery due to wear and tear, age, or obsolescence.

How often should machine value be recalculated?

Machine value should be recalculated annually to reflect current market conditions, any significant changes in the machine’s condition, or after any major repairs or upgrades.

Can the total machine depreciation exceed the original machine price?

No, the total machine depreciation cannot exceed the original machine price. Once the accumulated depreciation equals the original cost, the asset is fully depreciated and carries a net book value of zero.

Why is calculating machine value important?

Calculating machine value is important for financial reporting, tax purposes, and to make informed decisions about equipment replacement, maintenance, and investment.