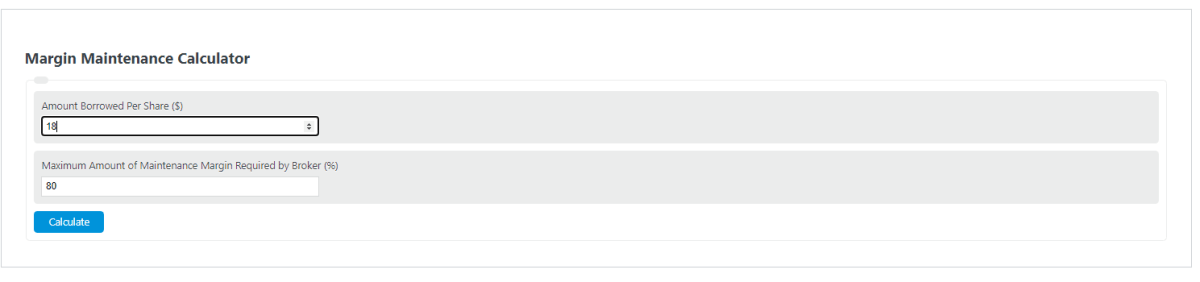

Enter the amount per share borrowed, and the maximum percentage of borrowed funds allowed to determine the maintenance margin.

- All Margin Calculators

- Shareholders Equity Calculator

- Dividends Per Share Calculator

- Profit-Sharing Calculator

- Margin Per Unit Calculator

Maintenance Margin Formula

The following formula is used to calculate a maintenance margin.

MM = BPS / (BA/100)

- Where MM($) is the maintenance margin ($)

- BPS is the amount borrowed per share ($)

- BA is the maximum percentage allowed to be borrowed against the shares.

To calculate maintenance margin, divide the amount borrowed per share by the maximum percentage of borrowing allowed.

Maintenance Margin Definition

A maintenance margin is defined as the minimum equity per share that an investment is required to have on hand in order to avoid a margin call. In other words, the minimum price a share can hit before a margin call is issued.

How to calculate maintenance margin?

First, determine the amount of money borrowed per share from your broker for the trade. To calculate this, simply multiply the market price by 1 minus the margin requirement. In this example, the margin requirement is 40% and the purchase price was 30$, so the amount borrowed per share is 30$*(1-.40) = $18 per share.

Next, determine the maximum percentage of borrow allowed by the maintenance margin of the broker. In this example, the maximum amount allowed to be borrowed is 80%.

Finally, calculate the maintenance margin amount per share using the formula above:

MM($) = $BPS / (%BA / 100)

= $18.00/.80

= $22.5 per share of maintenance margin

This is the lowest the share price can fall before being issued a margin call. Margin calls are actions taken by brokers that require an investor to cover the costs of their losses.