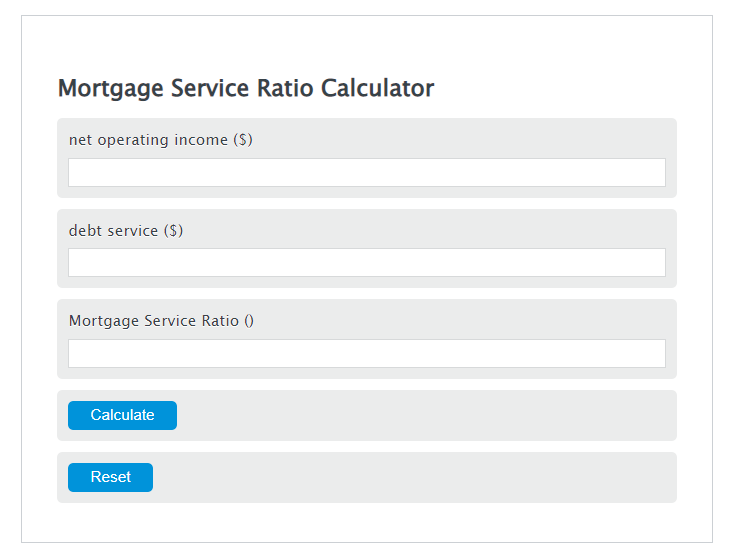

Enter the net operating income ($) and the debt service ($) into the Calculator. The calculator will evaluate the Mortgage Service Ratio.

- Debt Service Coverage Ratio Calculator

- Long-Term Debt Ratio Calculator

- Mortgage to Income Ratio Calculator

Mortgage Service Ratio Formula

MSR = NOI / DS

Variables:

- MSR is the Mortgage Service Ratio ()

- NOI is the net operating income ($)

- DS is the debt service ($)

To calculate Mortgage Service Ratio, divide the net operating income by the debt service.

How to Calculate Mortgage Service Ratio?

The following steps outline how to calculate the Mortgage Service Ratio.

- First, determine the net operating income ($).

- Next, determine the debt service ($).

- Next, gather the formula from above = MSR = NOI / DS.

- Finally, calculate the Mortgage Service Ratio.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

net operating income ($) = 500

debt service ($) = 234

Frequently Asked Questions

What is Net Operating Income (NOI) and why is it important in calculating the Mortgage Service Ratio?

Net Operating Income (NOI) is the total income generated from property operations minus the operating expenses. It is crucial for calculating the Mortgage Service Ratio because it reflects the property’s ability to generate enough income to cover its debt obligations.

How does the Debt Service (DS) affect the Mortgage Service Ratio?

The Debt Service (DS) represents the total amount of money required to cover the repayment of interest and principal on a debt for a particular period. A higher DS means more money is going towards debt repayment, affecting the Mortgage Service Ratio by potentially lowering it, indicating a higher financial burden.

Why is the Mortgage Service Ratio important for lenders and investors?

The Mortgage Service Ratio is a key metric for lenders and investors as it indicates the borrower’s ability to manage and service their mortgage debt with the income generated from the property. A higher ratio suggests better financial health and lower risk of default.

Can the Mortgage Service Ratio affect loan approval decisions?

Yes, the Mortgage Service Ratio can significantly affect loan approval decisions. Lenders use this ratio to assess the risk associated with lending. A higher ratio indicates that the property generates sufficient income to cover the mortgage payments, leading to a higher likelihood of loan approval.