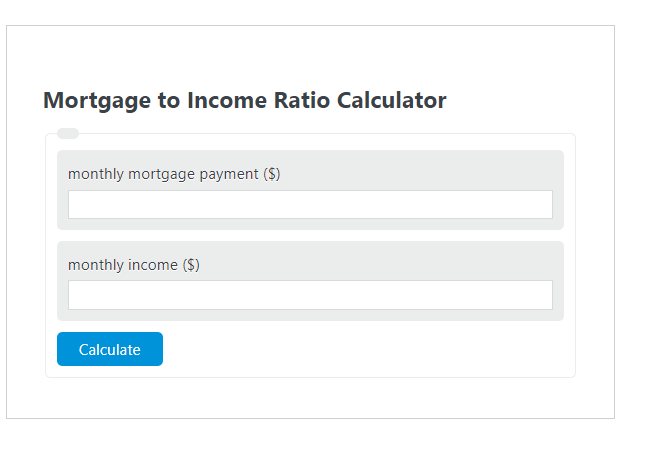

Enter the monthly mortgage payment ($) and the monthly income ($) into the Mortgage to Income Ratio Calculator. The calculator will evaluate and display the Mortgage to Income Ratio.

- All Ratio Calculators

- Rent to Income Ratio Calculator

- Income Rent Ratio Calculator

- Home Affordability Calculator (28/36 rule)

Mortgage to Income Ratio Formula

The following formula is used to calculate the Mortgage to Income Ratio.

MIR = MP / MI

- Where MIR is the Mortgage to Income Ratio (mortgage:income)

- MP is the monthly mortgage payment ($)

- MI is the monthly income ($)

To calculate the mortgage-to-income ratio, divide the monthly mortgage payment by the monthly gross income.

How to Calculate Mortgage to Income Ratio?

The following example problems outline how to calculate Mortgage to Income Ratio.

Example Problem #1:

- First, determine the monthly mortgage payment ($).

- The monthly mortgage payment ($) is given as: 2,000.

- Next, determine the monthly income ($).

- The monthly income ($) is provided as: 5,000.

- Finally, calculate the Mortgage to Income Ratio using the equation above:

MIR = MP / MI

The values given above are inserted into the equation below and the solution is calculated:

MIR = 2,000 / 5,000 = .40 (mortgage:income)

FAQ

What is a good Mortgage to Income Ratio?

A good Mortgage to Income Ratio is generally considered to be around 28% or lower. This means that your monthly mortgage payment should not exceed 28% of your gross monthly income. Lenders use this ratio to assess the affordability of a mortgage for a borrower.

How does Mortgage to Income Ratio affect loan approval?

Lenders use the Mortgage to Income Ratio as one of the key factors to determine loan approval. A lower ratio indicates that the borrower has a manageable level of debt relative to their income, which increases the likelihood of loan approval. A higher ratio may signal financial strain, potentially leading to difficulties in obtaining a loan.

Can improving my Mortgage to Income Ratio help me get a better interest rate?

Yes, improving your Mortgage to Income Ratio can help you secure a better interest rate. Lenders often offer more favorable rates to borrowers who present a lower risk. A lower Mortgage to Income Ratio suggests that you have a healthier balance between debt and income, making you a more attractive candidate for lower interest rates.