Enter the current value of the asset or property and the purchase price of the asset or property into the calculator to determine the negative equity.

- Shareholders Equity Calculator

- Total Equity Calculator

- Owner’s Equity Calculator

- Equity Value Calculator

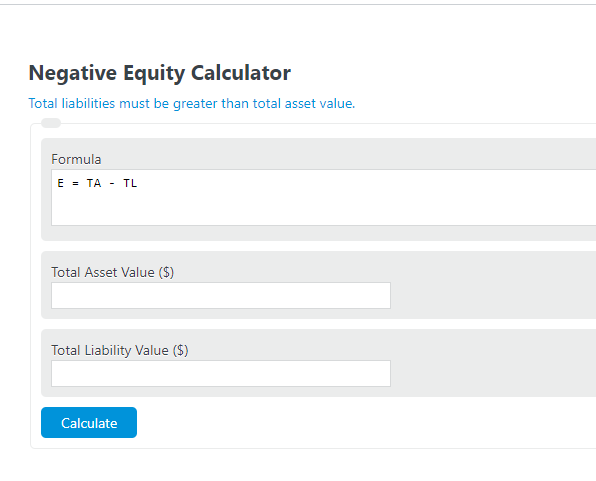

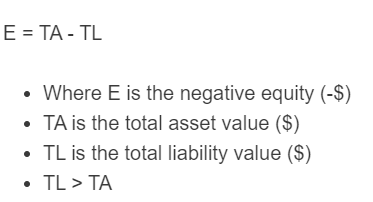

Negative Equity Formula

The following formula is used to calculate negative equity.

E = TA - TL

- Where E is the negative equity (-$)

- TA is the total asset value ($)

- TL is the total liability value ($)

The total asset value refers to the sum of all assets owned by an individual, company, or organization.

Total liability value refers to the total amount of financial obligations or debts that a company or individual is responsible for.

Negative Equity Definition

What is negative equity? Negative equity is defined as the difference between the total asset value and total liability value when the liability is greater than the asset value. In other words, the point at which the difference becomes negative.

Example Problem

How to calculate negative equity?

- First, determine the liability value.

For this problem, a person had purchased a house in 2007, just before the crash from a total mortgage value of $300,000.00

- Next, determine the current asset value.

After the crash in 2008, the market price of the property drops to $200,000.00.

- Finally, calculate the negative equity.

Using the formula above, we find the negative equity to be -$100,000.00.

About Negative Equity

Is negative equity possible? Not only is negative equity possible, but it is often likely to occur in the short term when purchasing a large asset. For example, if you just purchased a house complete on credit through a mortgage with 0% down, you would be immediately in negative equity after purchase. This is because, with closing costs, the total cost of the mortgage will be more than the market price you paid.

Is negative equity insolvency? Insolvency is not the same as negative equity. Insolvency means that a business can no longer pay its liabilities on time. Negative equity simply means that the total value of liabilities is larger than the total asset value. As long as the company brings in enough to pay the liability on time, it is not insolvent.

Does negative equity affect your credit? Negative equity does not necessarily affect your credit poorly. For example, when you take out a car loan, it’s almost always considered negative equity immediately after purchase because the car depreciates immediately. However, your credit score may go up because you are opening another line of credit.