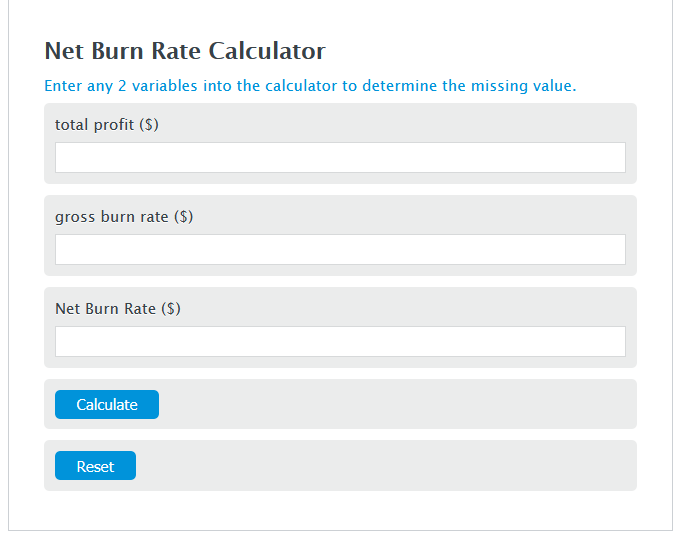

Enter the total profit ($) and the gross burn rate ($) into the Calculator. The calculator will evaluate the Net Burn Rate.

Net Burn Rate Formula

NBR = TP - GBR

Variables:

- NBR is the Net Burn Rate ($)

- TP is the total profit ($)

- GBR is the gross burn rate ($)

To calculate Net Burn Rate, subtract the gross burn rate from the total profit.

How to Calculate Net Burn Rate?

The following steps outline how to calculate the Net Burn Rate.

- First, determine the total profit ($).

- Next, determine the gross burn rate ($).

- Next, gather the formula from above = NBR = TP – GBR.

- Finally, calculate the Net Burn Rate.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

total profit ($) = 300

gross burn rate ($) = 20

FAQs about Net Burn Rate

What is the significance of calculating Net Burn Rate for a business?

Calculating Net Burn Rate is crucial for a business as it helps determine the rate at which a company is spending its capital before generating positive cash flow from operations. It’s a key metric for understanding the financial health and runway of a startup or any business in its early stages.

How can a company improve its Net Burn Rate?

A company can improve its Net Burn Rate by increasing its total profit, decreasing its gross burn rate, or a combination of both. This can be achieved by enhancing revenue streams, optimizing operational costs, and managing expenditures more efficiently.

Is a lower Net Burn Rate always better?

While a lower Net Burn Rate indicates a slower rate of cash consumption, it’s not always necessarily better. Strategic investments that temporarily increase the burn rate might be essential for growth. The key is maintaining a balance that supports sustainable growth without jeopardizing financial stability.

Can Net Burn Rate predict the future success of a company?

While the Net Burn Rate provides valuable insights into a company’s cash flow and financial sustainability, it’s not a standalone predictor of future success. Other factors such as market potential, product demand, competitive landscape, and the company’s ability to adapt and innovate also play critical roles.