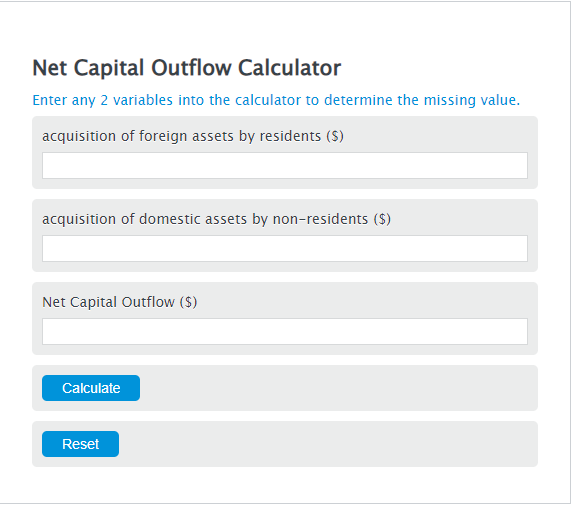

Enter the acquisition of foreign assets by residents ($) and the acquisition of domestic assets by non-residents ($) into the Calculator. The calculator will evaluate the Net Capital Outflow.

- Net Capital Spending Calculator

- Sales To Net Working Capital Ratio Calculator

- Capital Charge Factor Calculator

Net Capital Outflow Formula

NCO = AAF - ADNR

Variables:

- NCO is the Net Capital Outflow ($)

- AAF is the acquisition of foreign assets by residents ($)

- ADNR is the acquisition of domestic assets by non-residents ($)

To calculate the Net Capital Outflow, subtract the value of acquisitions of domestic assets by non-residents from the value of acquisitions of foreign assets by residents.

How to Calculate Net Capital Outflow?

The following steps outline how to calculate the Net Capital Outflow.

- First, determine the acquisition of foreign assets by residents ($).

- Next, determine the acquisition of domestic assets by non-residents ($).

- Next, gather the formula from above = NCO = AAF – ADNR.

- Finally, calculate the Net Capital Outflow.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

acquisition of foreign assets by residents ($) = 100000

acquisition of domestic assets by non-residents ($) = 20000

Frequently Asked Questions

What is Net Capital Outflow (NCO)?

Net Capital Outflow (NCO) refers to the difference between the purchase of foreign assets by a country’s residents and the purchase of the country’s assets by non-residents. It is a measure used in economics to gauge the flow of capital in and out of a country.

Why is calculating Net Capital Outflow important?

Calculating NCO is crucial for understanding a country’s economic health. A positive NCO indicates that a nation is investing more abroad than the world is investing in it, which can be a sign of economic strength. Conversely, a negative NCO suggests that a country is receiving more investment from abroad than it is making overseas, which could indicate economic challenges.

How does Net Capital Outflow affect a country’s economy?

Net Capital Outflow can impact a country’s economy in several ways. A high NCO can lead to a stronger currency and affect the country’s balance of payments. It can also influence interest rates and investment flows. Understanding NCO helps policymakers and economists make informed decisions about monetary policy and foreign investment strategies.

Can Net Capital Outflow be negative, and what does it mean?

Yes, Net Capital Outflow can be negative. This occurs when the acquisition of domestic assets by non-residents exceeds the acquisition of foreign assets by residents. A negative NCO indicates that a country is a net receiver of investment from the rest of the world. While this can be beneficial in the short term by providing the country with capital, it may also signal reliance on foreign investment for economic growth.