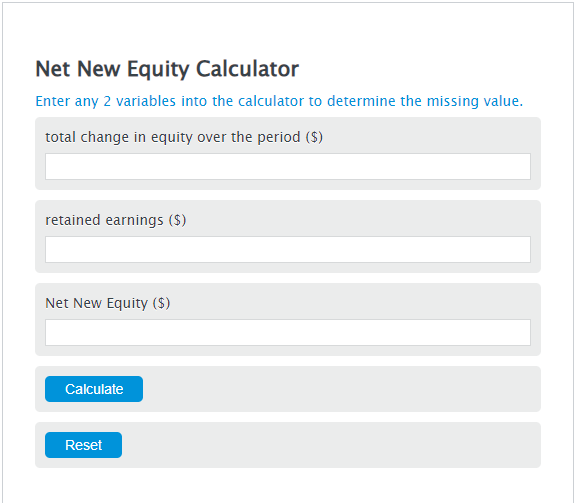

Enter the total change in equity over the period ($) and the retained earnings ($) into the Calculator. The calculator will evaluate the Net New Equity.

Net New Equity Formula

NNE = TCE - RE

Variables:

- NNE is the Net New Equity ($)

- TCE is the total change in equity over the period ($)

- RE is the retained earnings ($)

To calculate the Net New Equity, subtract the retained earnings from the total change in equity over the period.

How to Calculate Net New Equity?

The following steps outline how to calculate the Net New Equity.

- First, determine the total change in equity over the period ($).

- Next, determine the retained earnings ($).

- Next, gather the formula from above = NNE = TCE – RE.

- Finally, calculate the Net New Equity.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

total change in equity over the period ($) = 500

retained earnings ($) = 300

Frequently Asked Questions

What is Net New Equity?

Net New Equity (NNE) represents the amount of equity capital that has been added to a company’s equity, excluding any increases from retained earnings. It is calculated by subtracting retained earnings from the total change in equity over a specific period.

Why is understanding Net New Equity important for investors?

Understanding Net New Equity is crucial for investors as it provides insight into how a company is financing its operations and growth. A high Net New Equity could indicate that a company is raising a significant amount of capital through issuing new shares, which might dilute the value of existing shares. Conversely, a low or negative value might suggest that the company is relying more on its profits (retained earnings) to fund its activities, which can be a sign of financial health and stability.

How does the issuance of new shares affect Net New Equity?

The issuance of new shares increases a company’s total equity as it brings in new capital. This increase in total equity, when retained earnings are subtracted, results in a higher Net New Equity. This is because the formula for Net New Equity is the total change in equity minus retained earnings. Therefore, issuing new shares directly contributes to the Net New Equity by increasing the total equity.

Can Net New Equity be negative? If so, what does it mean?

Yes, Net New Equity can be negative. This occurs when the retained earnings exceed the total change in equity over the period. A negative Net New Equity might indicate that the company is not raising new equity capital but rather relying on its retained earnings to finance its operations and growth. This could be seen as a positive sign of financial health, as it suggests the company is generating sufficient profits and does not need to dilute existing shareholders’ equity by issuing new shares.