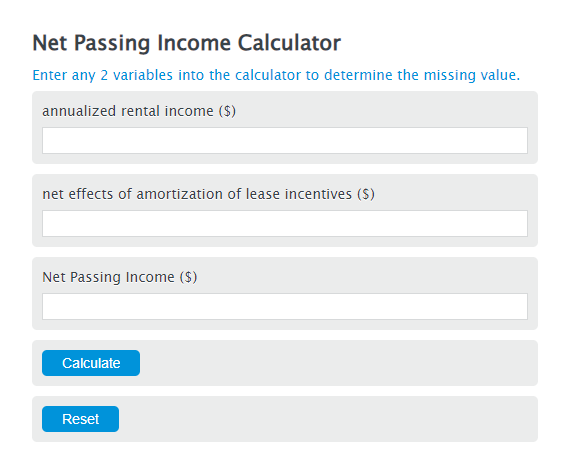

Enter the annualized rental income ($) and the net effects of amortization of lease incentives ($) into the Calculator. The calculator will evaluate the Net Passing Income.

Net Passing Income Formula

NPI = ARI - NEA

Variables:

- NPI is the Net Passing Income ($)

- ARI is the annualized rental income ($)

- NEA is the net effects of amortization of lease incentives ($)

To calculate the Net Passing Income, subtract the net effects on amortization

How to Calculate Net Passing Income?

The following steps outline how to calculate the Net Passing Income.

- First, determine the annualized rental income ($).

- Next, determine the net effects of amortization of lease incentives ($).

- Next, gather the formula from above = NPI = ARI – NEA.

- Finally, calculate the Net Passing Income.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

annualized rental income ($) = 15000

net effects of amortization of lease incentives ($) = 1000

FAQ

What is annualized rental income?

Annualized rental income refers to the total amount of rent collected from a property over a year. It includes all sources of rent and is calculated before any expenses are deducted.

How do lease incentives affect net passing income?

Lease incentives, such as free rent periods or contributions to fit-out costs, can affect net passing income by reducing the effective rental income over the lease term. The amortization of these incentives is deducted from the annualized rental income to calculate the net passing income.

Why is calculating net passing income important?

Calculating net passing income is crucial for property investors and landlords as it provides a clearer picture of the actual income generated from a property, taking into account the effects of lease incentives. This helps in evaluating the investment’s performance and making informed decisions.

Can net passing income change over time?

Yes, net passing income can change over time due to factors such as rental increases, lease renewals, and changes in lease incentives. Regularly recalculating net passing income is important for accurate financial planning and investment analysis.