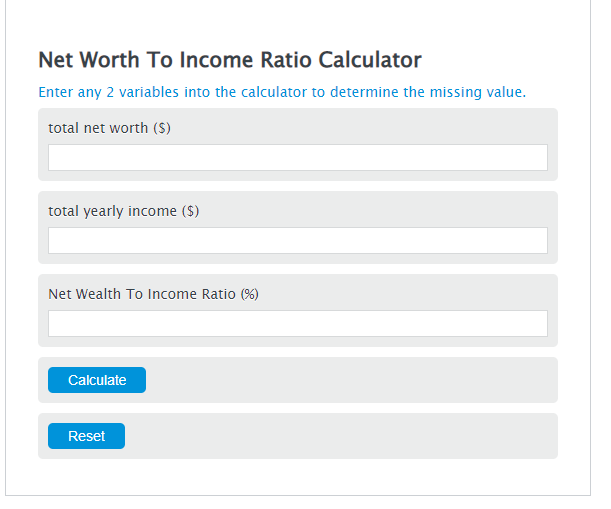

Enter the total net worth ($) and the total yearly income ($) into the Calculator. The calculator will evaluate the Net Wealth To Income Ratio.

- Sales To Net Working Capital Ratio Calculator

- Return on Net Worth Calculator

- Expense to Income Ratio Calculator

Net Wealth To Income Ratio Formula

NWI = NW / I *100

Variables:

- NWI is the Net Wealth To Income Ratio (%)

- NW is the total net worth ($)

- I is the total yearly income ($)

To calculate Net Wealth To Income Ratio, divide the net worth by the yearly income, then multiply by 100.

How to Calculate Net Wealth To Income Ratio?

The following steps outline how to calculate the Net Wealth To Income Ratio.

- First, determine the total net worth ($).

- Next, determine the total yearly income ($).

- Next, gather the formula from above = NWI = NW / I *100.

- Finally, calculate the Net Wealth To Income Ratio.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

total net worth ($) = 50000

total yearly income ($) = 120000

FAQs

What does the Net Wealth To Income Ratio indicate?

The Net Wealth To Income Ratio is a financial metric that indicates how many years it would take to reach one's current net worth if they saved their entire yearly income. A higher ratio suggests greater financial stability and wealth accumulation.

Why is it important to calculate the Net Wealth To Income Ratio?

Calculating this ratio can provide insights into an individual's financial health, helping to assess whether they are on track with their wealth accumulation goals. It can also aid in financial planning and decision-making.

Can the Net Wealth To Income Ratio vary significantly over time?

Yes, the ratio can vary due to changes in income, net worth, or both. Significant life events, investments, or shifts in spending habits can all affect the ratio.

How can someone improve their Net Wealth To Income Ratio?

Improving the ratio can be achieved by increasing net worth through savings, investments, and paying down debts, or by increasing yearly income through career advancement or additional income streams.