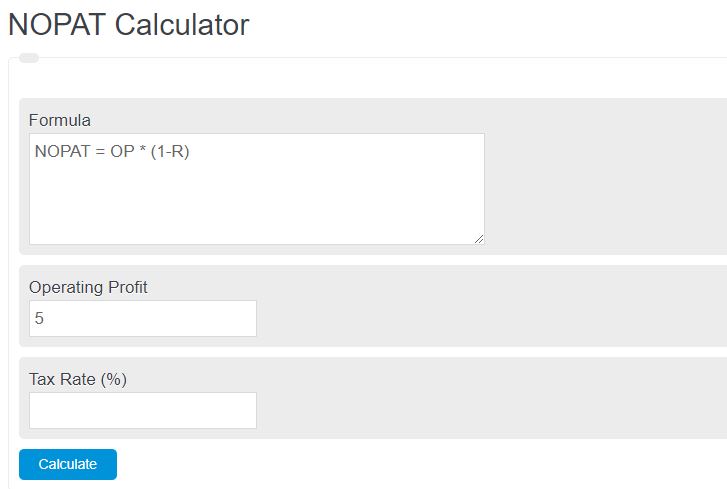

Enter the total operating profit and the tax rate. The calculator will determine the NOPAT or net operating profit after tax.

- Degree of Operating Leverage Calculator (+ Formula)

- Profitability Index Calculator

- Stock Calculator (Profit Calculator)

- Operating Margin Calculator

NOPAT Formula

The following formula is used to calculate the net operating profit after tax.

NOPAT = OP * (1-R)

- Where NOPAT is net operating profit after tax

- OP is the operating profit

- R is the tax rate

NOPAT (net operating profit after tax) Definition

NOPAT, or net operating profit after tax, is a financial metric that represents a company’s profitability from its core operations after deducting taxes. It is computed by subtracting the income tax expense from the company’s operating profit.

NOPAT is important because it provides a clearer picture of a company’s operating performance by excluding the impact of taxes. By focusing on the profit generated solely from core operations, it helps investors and analysts assess the company’s ability to generate profits from its day-to-day business activities. This metric allows for more accurate comparisons of profitability across companies and industries, as tax rates can vary significantly.

NOPAT is commonly used in financial models and valuation techniques like Economic Value Added (EVA) or discounted cash flow (DCF) analysis. These models help determine the value of a company by considering its ability to generate profits after taxes without the influence of financing decisions or tax strategies. By using NOPAT, analysts can better evaluate a company’s underlying profitability and make informed investment decisions.

NOPAT Example

How to calculate NOPAT?

- First, determine the operating profit.

Calculate the total operating profit.

- Next, determine the tax rate.

Determine the effective tax rate.

- Finally, calculate the NOPAT.

Calculate the NOPAT using the formula above.

FAQ

Why is NOPAT an important metric for investors and analysts?NOPAT is crucial because it offers a clear view of a company’s operational performance by isolating profit generated from core activities, allowing for better comparison and investment decisions.

How does NOPAT differ from net income?NOPAT focuses solely on operating profit after taxes, excluding non-operational income and expenses, while net income includes all revenue and costs, including those from non-core operations.

Can NOPAT be negative?Yes, NOPAT can be negative if a company’s operating expenses exceed its gross income, indicating that it is not profitable from its core operations.

How do changes in tax rates affect NOPAT?Changes in tax rates directly impact NOPAT, as it is calculated after taxes. A higher tax rate reduces NOPAT, while a lower tax rate increases it, all else being equal.