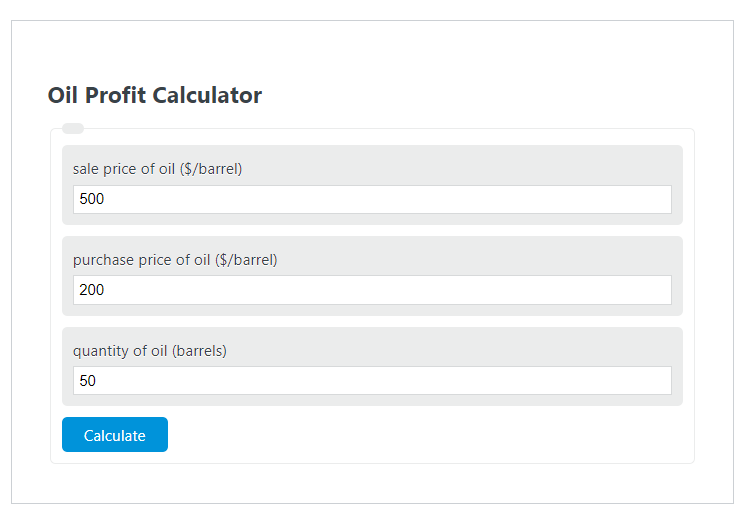

Enter the sale price of oil ($/barrel), the purchase price of oil ($/barrel), and the quantity of oil (barrels) into the calculator to determine the Oil Profit.

Oil Profit Formula

The following formula is used to calculate the Oil Profit.

OP = (SO - PO) *QO

- Where OP is the Oil Profit ($)

- SO is the sale price of oil ($/barrel)

- PO is the purchase price of oil ($/barrel)

- QO is the quantity of oil (barrels)

How to Calculate Oil Profit?

The following example problems outline how to calculate Oil Profit.

Example Problem #1

- First, determine the sale price of oil ($/barrel). In this example, the sale price of oil ($/barrel) is given as 50 .

- Next, determine the purchase price of oil ($/barrel). For this problem, the purchase price of oil ($/barrel) is given as 25 .

- Next, determine the quantity of oil (barrels). In this case, the quantity of oil (barrels) is found to be 100.

- Finally, calculate the Oil Profit using the formula above:

OP = (SO – PO) *QO

Inserting the values from above yields:

OP = (50 – 25) *100 = 2,500.00 ($)

FAQ

What factors can affect the sale and purchase price of oil?

The sale and purchase price of oil can be affected by a variety of factors including geopolitical events, supply and demand dynamics, technological advancements in extraction and production, changes in currency values, and government policies related to energy and environmental protection.

How can one track the fluctuating prices of oil?

Individuals and businesses can track the fluctuating prices of oil through financial news websites, commodity trading platforms, official government publications, and market analysis reports. Subscribing to real-time alerts from these sources can also help in staying updated with the latest price movements.

Are there any strategies to mitigate risks when trading oil?

Yes, traders can employ several strategies to mitigate risks when trading oil, such as diversification of investment portfolio, using futures contracts to hedge against price volatility, staying informed about market trends and geopolitical events that may affect oil prices, and setting stop-loss orders to limit potential losses.