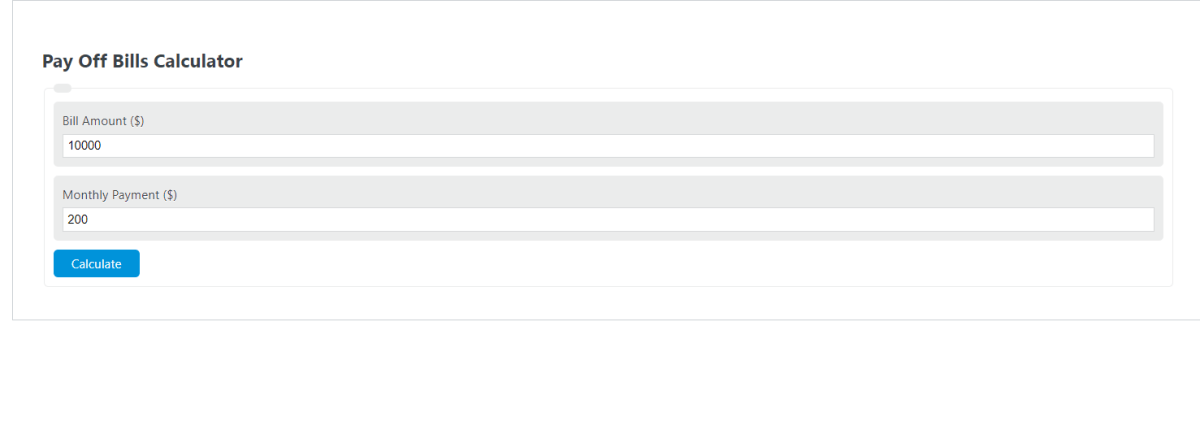

Enter the total bill amount and the monthly payment into the calculator to determine the time to pay off bills.

- All Bill Calculators

- Billable Hours Calculator

- Water Bill Calculator

- Prorated Rent Calculator

- Rent Budget Calculator – How much should I spend on rent?

Pay Off Bills Formula

The following equation is used to calculate the time to pay off bills.

T = BA / MP

- Where T is the time to pay off bills (months)

- BA is the total bill amount ($)

- MP is the monthly payment made on the bill ($)

To calculate the time to pay off bills, divide the total bill amount by the monthly payment made on the bill.

How Long Does it Take to Pay Off Bills?

Definition:

The time it takes to pay off bills depends on two factors:

- The total amount of the bill. The higher the bill amount, the longer it will take to pay off.

- The monthly payment made on the bill. The greater the monthly payment, the quicker the bill will be paid off.

How to Calculate Time to Pay Off Bills?

Example Problem:

The following example outlines the steps and information needed to calculate the time to pay off bills.

First, determine the amount of the bill. In this example, the amount of the bill is $10,000.00.

Next, determine the monthly payment made on this bill. In this case, the monthly payment is $200.00.

Finally, calculate the time it takes to pay off the bill using the formula above:

T = BA / MP

T = 10,000/200

T = 50 months = 4.166 years

FAQ

What factors can affect the accuracy of the time to pay off bills calculation?

Several factors can affect the accuracy of the calculation, including changes in the interest rate (if applicable), additional charges or fees added to the bill, changes in the monthly payment amount, and early payments or additional payments made towards the bill.

Can this formula be used for any type of bill?

Yes, this formula can be applied to any type of bill as long as you have a fixed total bill amount and a consistent monthly payment amount. However, for bills with variable interest rates or additional fees, the actual time to pay off might vary.

How can making additional payments affect the time to pay off bills?

Making additional payments towards your bill can significantly reduce the time it takes to pay off the bill. Since additional payments decrease the principal balance faster, less interest accumulates over time (if applicable), allowing you to pay off the bill sooner than originally calculated.