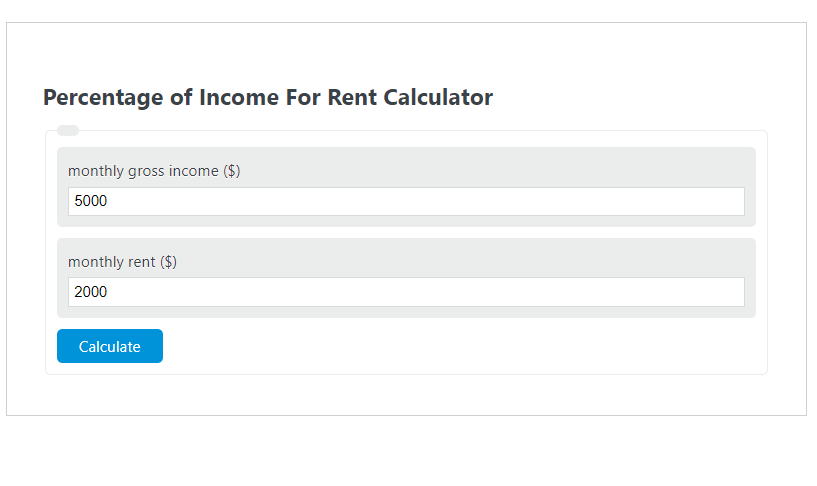

Enter the monthly gross income ($) and the monthly rent ($) into the calculator to determine the Percentage of Income For Rent.

Percentage of Income For Rent Formula

The following formula is used to calculate the Percentage of Income For Rent.

RP = R / MGI * 100

- Where RP is the Percentage of Income For Rent (%)

- MGI is the monthly gross income ($)

- R is the monthly rent ($)

To calculate the percentage of income for rent, divide the monthly gross income by the rent, then multiply by 100.

In general, a person’s rent should be less than 40% of their monthly gross income.

How to Calculate Percentage of Income For Rent?

The following example problems outline how to calculate the Percentage of Income For Rent.

Example Problem #1:

- First, determine the monthly gross income ($). In this example, the monthly gross income ($) is given as 5000.

- Next, determine the monthly rent ($). For this problem, the monthly rent ($) is given as 3000.

- Finally, calculate the Percentage of Income For Rent using the equation above:

R% = R / MGI * 100

The values given above are inserted into the equation below:

R% = 3000 / 5000 * 100 = 60 (%)

FAQ

What is considered a good percentage of income to spend on rent?

Generally, it is recommended that individuals spend no more than 30% to 40% of their monthly gross income on rent. This guideline helps ensure that renters have enough budget left for other expenses and savings.

How can calculating the percentage of income for rent help in budgeting?

Calculating the percentage of income spent on rent can help individuals understand how much of their earnings are allocated towards housing. This awareness can aid in better budget management, ensuring that enough money is set aside for other essential expenses and savings.

What steps can be taken if the percentage of income for rent is too high?

If the percentage of income spent on rent is too high, individuals can consider options such as finding a more affordable housing solution, increasing their income, or budgeting to cut expenses in other areas. In some cases, roommates or government housing assistance programs may also be viable options to reduce housing costs.