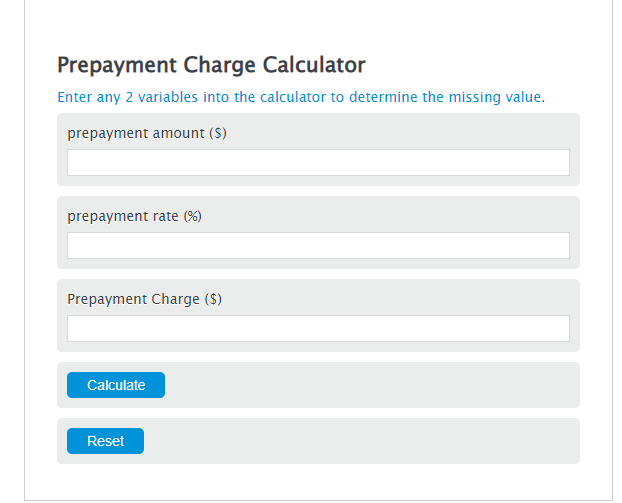

Enter the prepayment amount ($) and the prepayment rate (%) into the Calculator. The calculator will evaluate the Prepayment Charge.

- Repayment Capacity Calculator

- Constant/Conditional Prepayment Rate (CPR) Calculator

- Deficit Equity Calculator

Prepayment Charge Formula

PPC = PPA * PR/100

Variables:

- PPC is the Prepayment Charge ($)

- PPA is the prepayment amount ($)

- PR is the prepayment rate (%)

To calculate Prepayment Charge, multiply the prepayment amount by the prepayment rate.

How to Calculate Prepayment Charge?

The following steps outline how to calculate the Prepayment Charge.

- First, determine the prepayment amount ($).

- Next, determine the prepayment rate (%).

- Next, gather the formula from above = PPC = PPA * PR/100.

- Finally, calculate the Prepayment Charge.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

prepayment amount ($) = 3450

prepayment rate (%) = 1244

FAQs

What is a Prepayment Charge?

Prepayment Charge is a fee applied when a borrower pays off a loan earlier than scheduled. It compensates the lender for the interest revenue lost due to the early repayment.

How is the Prepayment Rate determined?

The Prepayment Rate is usually determined by the lender based on the terms of the loan agreement. It can vary depending on the type of loan, the duration of the loan, and other factors.

Can Prepayment Charges be avoided or reduced?

Some loans offer terms that allow for early repayment without charges, or with reduced charges, under certain conditions. Reviewing your loan agreement and discussing options with your lender can help identify opportunities to avoid or reduce these charges.

Why would someone choose to pay a Prepayment Charge?

Paying off a loan early can save on future interest payments, even after accounting for the Prepayment Charge. It can also be beneficial for borrowers looking to improve their debt-to-income ratio or to free up credit for other financial opportunities.