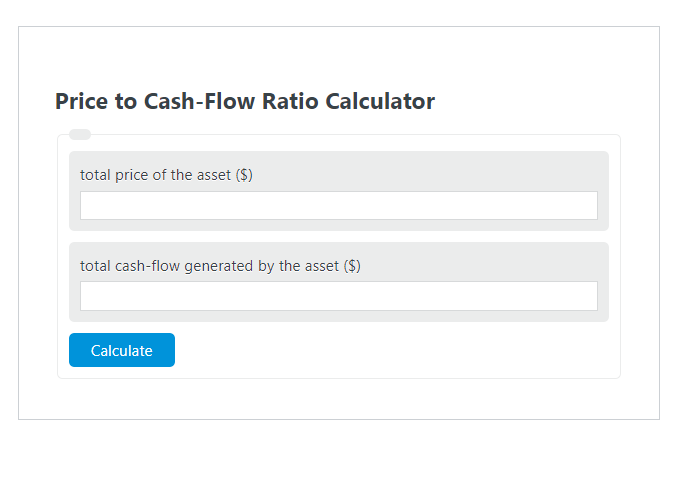

Enter the total price of the asset ($) and the total cash-flow generated by the asset ($) into the Price to Cash Flow Ratio Calculator. The calculator will evaluate and display the Price to Cash Flow Ratio.

- All Ratio Calculators

- Price to Sales Ratio Calculator

- Price-to-Rent Ratio Calculator

- Return on Cash Flow Calculator

Price to Cash Flow Ratio Formula

The following formula is used to calculate the Price to Cash Flow Ratio.

PCFR = P / CF

- Where PCFR is the Price to Cash Flow Ratio ( )

- P is the total price of the asset ($)

- CF is the total cash-flow generated by the asset ($)

To calculate the price-to-cash flow ratio, divide the price of the asset by the cash-flow it generates.

How to Calculate Price to Cash Flow Ratio?

The following example problems outline how to calculate Price to Cash Flow Ratio.

Example Problem #1:

- First, determine the total price of the asset ($).

- The total price of the asset ($) is given as: 100,000.

- Next, determine the total cash-flow generated by the asset ($).

- The total cash-flow generated by the asset ($) is provided as: 5,000.

- Finally, calculate the Price to Cash Flow Ratio using the equation above:

PCFR = P / CF

The values given above are inserted into the equation below and the solution is calculated:

PCFR = 100,000 / 5,000 = 20.00

FAQ

What is the significance of the Price to Cash Flow Ratio in financial analysis?

The Price to Cash Flow Ratio is a crucial metric in financial analysis as it helps investors and analysts evaluate the value of a company’s stock relative to the amount of cash flow it generates. A lower ratio may indicate that the company is undervalued or generating a significant amount of cash relative to its stock price, while a higher ratio could suggest overvaluation. This ratio is particularly useful in comparing the financial health and valuation of companies within the same industry.

How does the Price to Cash Flow Ratio differ from the Price to Earnings (P/E) Ratio?

The Price to Cash Flow Ratio differs from the Price to Earnings (P/E) Ratio in that it uses cash flow instead of net income as a measure of a company’s financial performance. Cash flow is considered a more reliable indicator of a company’s financial health since it is harder to manipulate than net income, which can be affected by various accounting practices and non-cash expenses. Therefore, the Price to Cash Flow Ratio can provide a clearer picture of a company’s true profitability and financial stability.

Can the Price to Cash Flow Ratio be used for all types of investments?

While the Price to Cash Flow Ratio is a valuable tool for evaluating stocks, its usefulness can vary across different types of investments. For instance, it is most applicable to companies with significant physical assets and operations that generate steady cash flows. However, it might not be as relevant for companies in the technology sector or startups, where cash flow can be irregular, and the business model focuses more on growth potential than current cash generation. Investors should consider other financial metrics and the specific context of the investment when using this ratio.