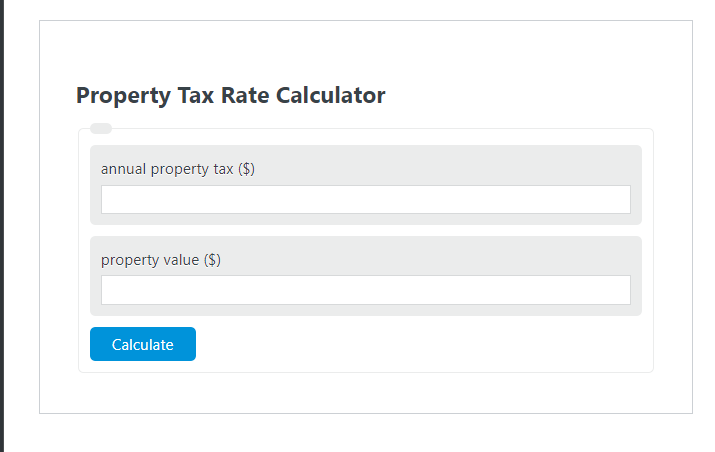

Enter the annual property tax ($) and the property value ($) into the Property Tax Rate Calculator. The calculator will evaluate the Property Tax Rate.

Property Tax Rate Formula

The following two example problems outline the steps and information needed to calculate the Property Tax Rate.

PTR = PT / V *100

- Where PTR is the Property Tax Rate (%)

- PT is the annual property tax ($)

- V is the property value ($)

How to Calculate Property Tax Rate?

The following example problems outline how to calculate Property Tax Rate.

Example Problem #1:

- First, determine the annual property tax ($).

- The annual property tax ($) is given as: 5000.

- Next, determine the property value ($).

- The property value ($) is provided as: 450,000.

- Finally, calculate the Property Tax Rate using the equation above:

PTR = PT / V *100

The values provided above are inserted into the equation below and computed.

PTR = 5,000 / 450,000 *100 = 1.11 (%)

Example Problem #2:

For this problem, the variables required are provided below:

annual property tax ($) = 6,000

property value ($) = 700,000

Test your knowledge using the equation and check your answer with the calculator..

PTR = PT / V *100 = ?