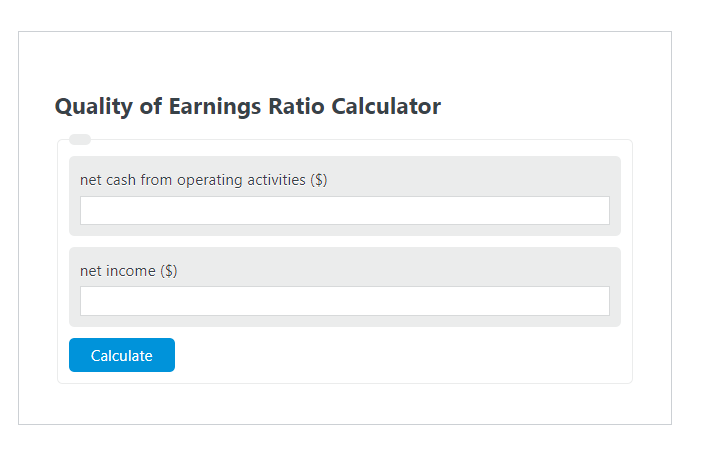

Enter the net cash from operating activities ($) and the net income ($) into the Quality of Earnings Ratio Calculator. The calculator will evaluate and display the Quality of Earnings Ratio.

- All Ratio Calculators

- Price/Earnings Ratio Calculator

- Operating Ratio Calculator

- Gain Ratio Calculator

Quality of Earnings Ratio Formula

The following formula is used to calculate the Quality of Earnings Ratio.

QER = NCO / NI

- Where QER is the Quality of Earnings Ratio

- NCO is the net cash from operating activities ($)

- NI is the net income ($)

To calculate the quality of earnings ratio, divide the net cash from operating activities by the total net income.

How to Calculate Quality of Earnings Ratio?

The following example problems outline how to calculate Quality of Earnings Ratio.

Example Problem #1:

- First, determine the net cash from operating activities ($).

- The net cash from operating activities ($) is given as: 1,600.

- Next, determine the net income ($).

- The net income ($) is provided as: 2,000.

- Finally, calculate the Quality of Earnings Ratio using the equation above:

QER = NCO / NI

The values given above are inserted into the equation below and the solution is calculated:

QER = 1600 / 2000 = .80

FAQ

What does a Quality of Earnings Ratio indicate about a company?

The Quality of Earnings Ratio indicates how much of a company’s earnings are derived from its core business operations, as opposed to non-operational sources such as investments. A higher ratio suggests that a greater proportion of the company’s earnings are the result of its operational activities, which is generally seen as a sign of a healthier, more sustainable business.

Can the Quality of Earnings Ratio vary significantly across different industries?

Yes, the Quality of Earnings Ratio can vary significantly across different industries due to the nature of their operations and income sources. Industries that are heavily reliant on operational activities for their income, such as manufacturing, may have a higher Quality of Earnings Ratio compared to industries that generate a significant portion of income from investments or other non-operational activities.

How can investors use the Quality of Earnings Ratio when evaluating a company?

Investors can use the Quality of Earnings Ratio to assess the financial health and sustainability of a company’s earnings. A higher ratio may indicate that the company’s earnings are more reliable and sustainable over the long term, making it potentially a more attractive investment. However, investors should also consider other financial metrics and factors in their overall evaluation of a company.