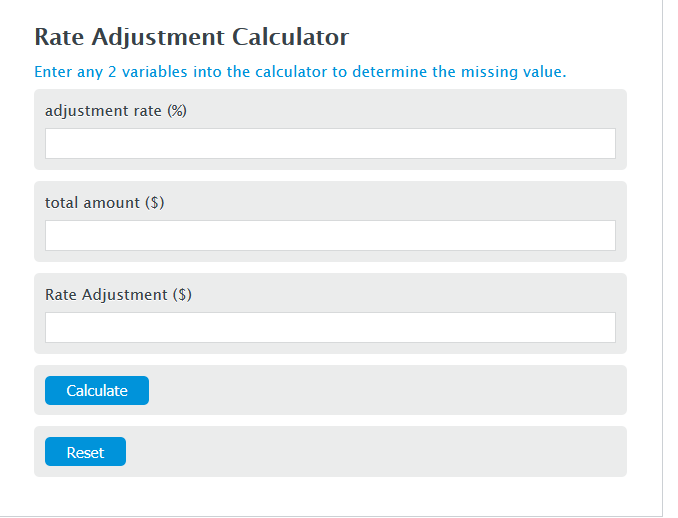

Enter the adjustment rate (%) and the total amount ($) into the Calculator. The calculator will evaluate the Rate Adjustment.

Rate Adjustment Formula

RA = AR/100 * A

Variables:

- RA is the Rate Adjustment ($)

- AR is the adjustment rate (%)

- A is the total amount ($)

To calculate Rate Adjustment, divide the adjustment rate by the total amount.

How to Calculate Rate Adjustment?

The following steps outline how to calculate the Rate Adjustment.

- First, determine the adjustment rate (%).

- Next, determine the total amount ($).

- Next, gather the formula from above = RA = AR/100 * A.

- Finally, calculate the Rate Adjustment.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

adjustment rate (%) = 5

total amount ($) = 883

FAQ Section

What is an adjustment rate?

An adjustment rate is a percentage that represents the amount of change applied to a total amount for the purpose of calculating a rate adjustment. It is used in various financial calculations to adjust values based on certain criteria or conditions.

Why is the Rate Adjustment formula important?

The Rate Adjustment formula is crucial for accurately calculating the adjusted amount based on a specific rate. This calculation is essential in finance and economics to determine the impact of changes in rates on total amounts, helping in decision-making processes.

Can the Rate Adjustment formula be used for both increases and decreases?

Yes, the Rate Adjustment formula can be used to calculate both increases and decreases in the total amount. The adjustment rate can be positive for increases or negative for decreases, affecting the final adjusted amount accordingly.

How can Rate Adjustment calculations benefit individuals and businesses?

For individuals, Rate Adjustment calculations can help in personal finance management, such as adjusting loan amounts or savings based on interest rates. For businesses, these calculations are vital for financial planning, budgeting, and assessing the impact of changes in financial markets or interest rates on their operations and investments.