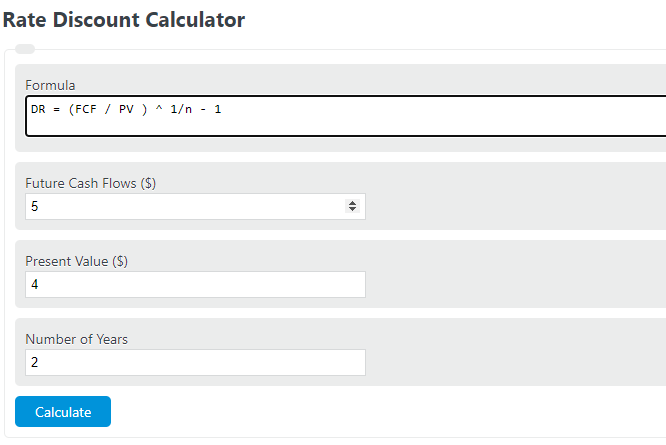

Enter the current present value, future cash flow, and the number of periods into the calculator to determine the rate discount.

Rate Discount Formula

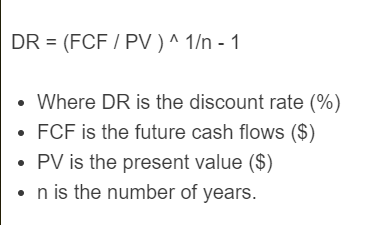

The following is the discount rate formula:

DR = (FCF / PV ) ^ 1/n - 1

- Where DR is the discount rate (%)

- FCF is the future cash flows ($)

- PV is the present value ($)

- n is the number of years.

Discount Rate Definition

A discount rate is the interest rate used to calculate the present value of future cash flows. It is a crucial concept in finance as it helps determine the current value of future income or expenses.

Are discount rate and irr the same?

Discount rate and IRR (internal rate of return) are not the same, but the discount rate is used in the computation of the IRR. To learn more about IRR, visit our internal rate of return calculator.

Can a discount rate be negative?

Yes, in the case where the future cash flows are expected to be less than the present value, the discount rate will end up being negative.

Is discount rate annual?

The discount rate is considered annual. You can see this in the formula DR = (FCF / PV ) ^ 1/n - 1, where n is the number of years. Years can be a substitute for months or periods, but it's most often used as analysis on an annual basis.

What does discount rate mean?

A discount rate is a way of describing the time value of money. The time value of money says that an equal amount of money now is worth more than the same amount in the future.

Does discount rate change over time?

A discount rate can change over time as changes in inflation, lending rates, and other factors change throughout an economy.

How to calculate rate discount?

- First, determine the future cash flows. Calculate or determine the expected cash flows in the future.

- Next, determine the current present value of the money or investment.

- Next, determine the number of years.

- Finally, calculate the rate discount using the formula provided above.