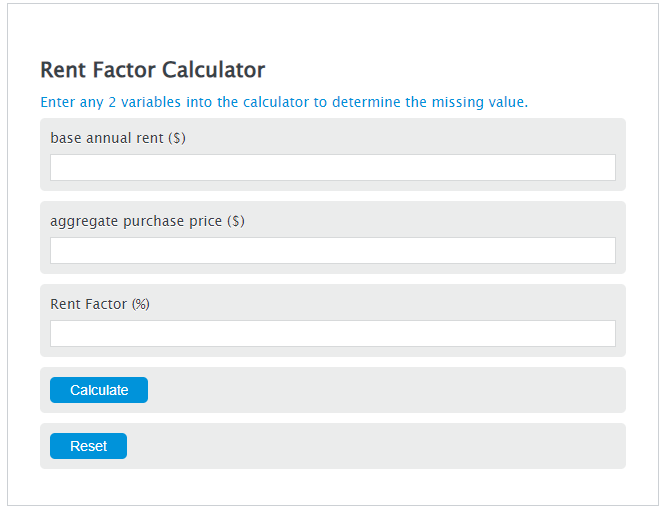

Enter the base annual rent ($) and the aggregate purchase price ($) into the Calculator. The calculator will evaluate the Rent Factor.

Rent Factor Formula

RF = BAR / APP *100

Variables:

- RF is the Rent Factor (%)

- BAR is the base annual rent ($)

- APP is the aggregate purchase price ($)

To calculate Rent Factor, divide the base annual rent by the aggregate purchase price, then multiply by 100.

How to Calculate Rent Factor?

The following steps outline how to calculate the Rent Factor.

- First, determine the base annual rent ($).

- Next, determine the aggregate purchase price ($).

- Next, gather the formula from above = RF = BAR / APP *100.

- Finally, calculate the Rent Factor.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

base annual rent ($) = 60000

aggregate purchase price ($) = 600000

FAQs

What is the significance of calculating the Rent Factor?

Calculating the Rent Factor helps investors and property owners understand the rental yield of a property relative to its purchase price, enabling better investment decisions.

Can the Rent Factor calculation be used for any type of property?

Yes, the Rent Factor calculation can be applied to various types of properties, including residential, commercial, and industrial properties, as long as you have the base annual rent and the aggregate purchase price.

How does the Rent Factor affect investment decisions?

A higher Rent Factor indicates a higher rental income relative to the property's purchase price, potentially making it a more attractive investment. Conversely, a lower Rent Factor might signal a less desirable investment opportunity.

Are there any limitations to using the Rent Factor as the sole metric for property investment decisions?

While the Rent Factor provides valuable insight into the rental yield, investors should also consider other factors such as property location, market trends, maintenance costs, and potential for appreciation or depreciation before making an investment decision.