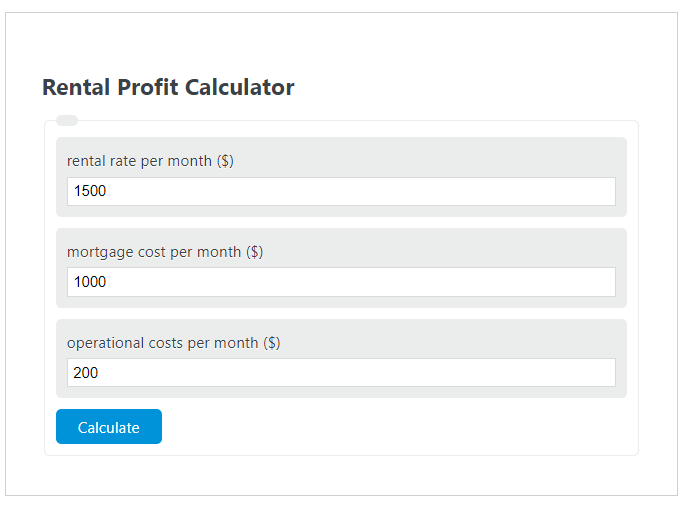

Enter the rental rate per month ($), the mortgage cost per month ($), and the operation costs per month ($) into the calculator to determine the Rental Profit.

- All Profit Calculators

- Real Estate Profit Calculator

- Rental Yield Calculator

- Rental Cash Flow Calculator

Rental Profit Formula

The following formula is used to calculate the Rental Profit.

Prental = RR - MR - OC

- Where Prental is the Rental Profit ($)

- RR is the rental rate per month ($)

- MR is the mortgage cost per month ($)

- OC is the operation costs per month ($)

To calculate the rental profit, subtract the operating costs per month and the mortgage cost per month from the rental rate per month.

How to Calculate Rental Profit?

The following example problems outline how to calculate Rental Profit.

Example Problem #1

- First, determine the rental rate per month ($). In this example, the rental rate per month ($) is given as 2000 .

- Next, determine the mortgage cost per month ($). For this problem, the mortgage cost per month ($) is given as 1500 .

- Next, determine the operation costs per month ($). In this case, the operation costs per month ($) is found to be 200.

- Finally, calculate the Rental Profit using the formula above:

Prental = RR – MR – OC

Inserting the values from above yields:

Prental = 2000 – 1500 – 200 = 300 ($)

FAQ

What factors can affect the rental profit for a property?

Rental profit can be influenced by several factors including the location of the property, market demand, the condition of the property, changes in mortgage interest rates, and fluctuating operating costs such as maintenance, property taxes, and insurance.

How can a property owner increase their rental profit?

A property owner can increase their rental profit by enhancing the property’s appeal to attract higher-paying tenants, implementing efficient property management to reduce operating costs, refinancing their mortgage to a lower interest rate, and staying competitive with rental pricing while optimizing for market demand.

Is it possible to have a negative rental profit, and what can be done in such scenarios?

Yes, it is possible to have a negative rental profit if the total expenses (mortgage plus operating costs) exceed the rental income. In such scenarios, property owners can look into reducing their expenses, increasing the rent within market limits, or possibly refinancing their mortgage. In some cases, it may also be beneficial to consider selling the property if the market conditions are favorable.