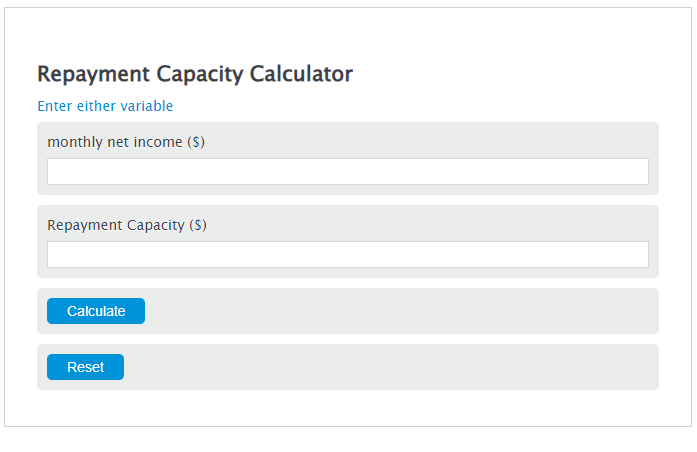

Enter the monthly net income ($) into the Calculator. The calculator will evaluate the Repayment Capacity.

Repayment Capacity Formula

RC = NI * .50

Variables:

- RC is the Repayment Capacity ($)

- NI is the monthly net income ($)

To calculate Repayment Capacity, simply multiply the monthly net income after taxes by 50%.

How to Calculate Repayment Capacity?

The following steps outline how to calculate the Repayment Capacity.

- First, determine the monthly net income ($).

- Next, gather the formula from above = RC = NI * .50.

- Finally, calculate the Repayment Capacity.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

monthly net income ($) = 5000

Frequently Asked Questions

What factors can affect my repayment capacity?

Several factors can affect your repayment capacity, including your monthly net income, existing debts, interest rates on those debts, and your overall living expenses. Changes in your financial situation, such as a salary increase or new financial obligations, can also impact your repayment capacity.

Is a higher repayment capacity always better?

Generally, a higher repayment capacity is considered better because it indicates that you have more financial flexibility to repay debts. However, it’s also important to save and invest for the future, so balancing debt repayment with other financial goals is crucial.

How can I improve my repayment capacity?

You can improve your repayment capacity by increasing your monthly net income through higher earnings or additional income sources. Reducing unnecessary expenses and paying down existing debts can also improve your repayment capacity by freeing up more of your income for future borrowing needs.

Can repayment capacity affect my ability to get a loan?

Yes, lenders often assess your repayment capacity when considering you for a loan. A strong repayment capacity can make you a more attractive borrower because it suggests that you’re more likely to be able to repay the loan. Conversely, a lower repayment capacity might limit your borrowing options or result in higher interest rates.