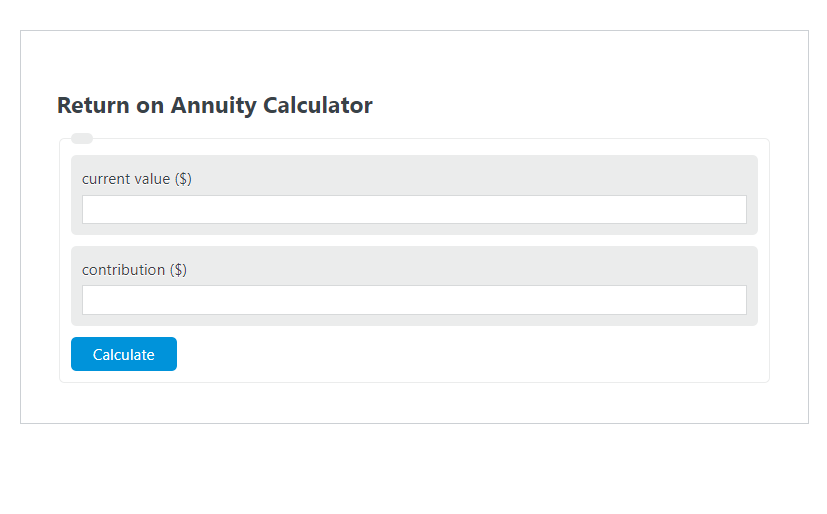

Enter the current value ($) and the contribution ($) into the Return on Annuity Calculator. The calculator will evaluate and display the Return on Annuity.

- Return on “X” Calculators

- Return on Investment Ratio Calculator

- Return on Cost Calculator

- Annuity Cost Calculator

Return on Annuity Formula

The following formula is used to calculate the Return on Annuity.

ROA = (CV - C ) / C *100

- Where ROA is the Return on Annuity (%)

- CV is the current value ($)

- C is the contribution ($)

How to Calculate Return on Annuity?

The following example problems outline how to calculate Return on Annuity.

Example Problem #1:

- First, determine the current value ($).

- The current value ($) is given as: 1500.

- Next, determine the contribution ($).

- The contribution ($) is provided as: 1000.

- Finally, calculate the Return on Annuity using the equation above:

ROA = (CV - C ) / C *100

The values given above are inserted into the equation below and the solution is calculated:

ROA = (1500 - 1000 ) / 1000 *100 = 50 (%)

FAQ

What is an Annuity?

An annuity is a financial product that pays out a fixed stream of payments to an individual, primarily used as an income stream for retirees. It's a contract between an individual and an insurance company where the individual pays a lump sum or series of payments in exchange for regular disbursements that can start either immediately or at some point in the future.

How does the Return on Annuity (ROA) differ from the Return on Investment (ROI)?

The Return on Annuity (ROA) specifically measures the profitability of an annuity investment by calculating the percentage increase or decrease in value of the annuity over the contribution amount. In contrast, the Return on Investment (ROI) is a broader measure that calculates the overall efficiency of an investment, comparing the gain or loss from an investment to its cost. While ROA is specific to annuities, ROI can be applied to a wide range of investments.

Why is it important to calculate the Return on Annuity?

Calculating the Return on Annuity is important for individuals to assess the performance and efficiency of their annuity investments. It helps in understanding how much profit or loss has been made in relation to the initial contribution, thereby aiding in financial planning and decision-making. It also allows investors to compare the profitability of different annuity products or other types of investments, ensuring they are making informed choices that align with their financial goals.