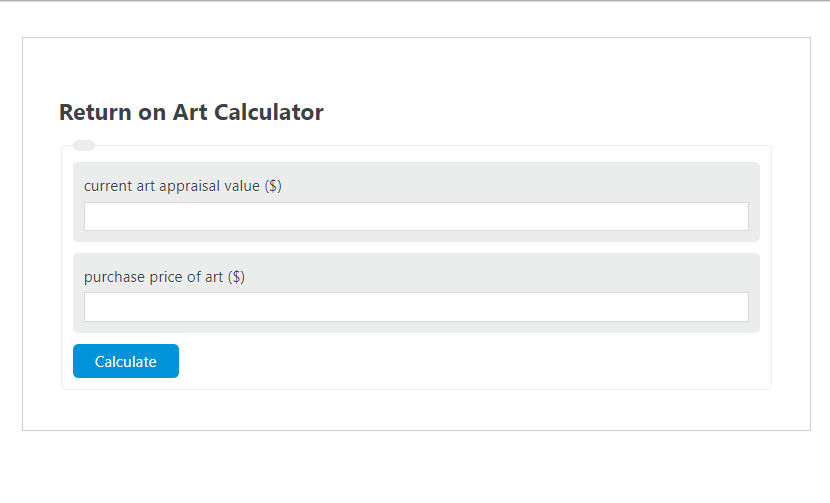

Enter the current art appraisal value ($) and the purchase price of art ($) into the Return on Art Calculator. The calculator will evaluate and display the Return on Art.

- Return on “X” Calculators

- Return on T-Bills Calculator

- Return On Principal Calculator

- Return on Revenue Calculator

Return on Art Formula

The following formula is used to calculate the Return on Art.

ROArt = (AV-P) / P * 100

- Where ROArt is the Return on Art (%)

- AV is the current art appraisal value ($)

- P is the purchase price of art ($)

How to Calculate Return on Art?

The following example problems outline how to calculate Return on Art.

Example Problem #1:

- First, determine the current art appraisal value ($).

- The current art appraisal value ($) is given as: 40,000.

- Next, determine the purchase price of art ($).

- The purchase price of art ($) is provided as: 30,000.

- Finally, calculate the Return on Art using the equation above:

ROArt = (AV-P) / P * 100

The values given above are inserted into the equation below and the solution is calculated:

ROArt = (40,000-30,000) / 30,000 * 100 = 33.33 (%)

FAQ

What factors can affect the appraisal value of art?

The appraisal value of art can be influenced by several factors including the artist’s reputation, the artwork’s provenance, its condition, rarity, historical significance, and current market trends. Additionally, external factors such as economic conditions and changes in consumer taste can also impact the appraisal value.

How often should art be appraised for accurate Return on Art calculations?

Art should ideally be appraised every 2 to 5 years or whenever there is a significant change in the art market or the piece’s condition. Regular appraisals ensure that the Return on Art calculations are based on the most current market values, providing a more accurate reflection of the artwork’s investment performance.

Can the Return on Art formula be applied to other collectibles or investments?

Yes, the Return on Art formula, which calculates the percentage return based on the current value and purchase price, can be adapted for use with other types of investments or collectibles, such as vintage cars, rare books, or real estate. However, it’s important to consider the unique factors affecting the value and liquidity of each type of investment when making comparisons.