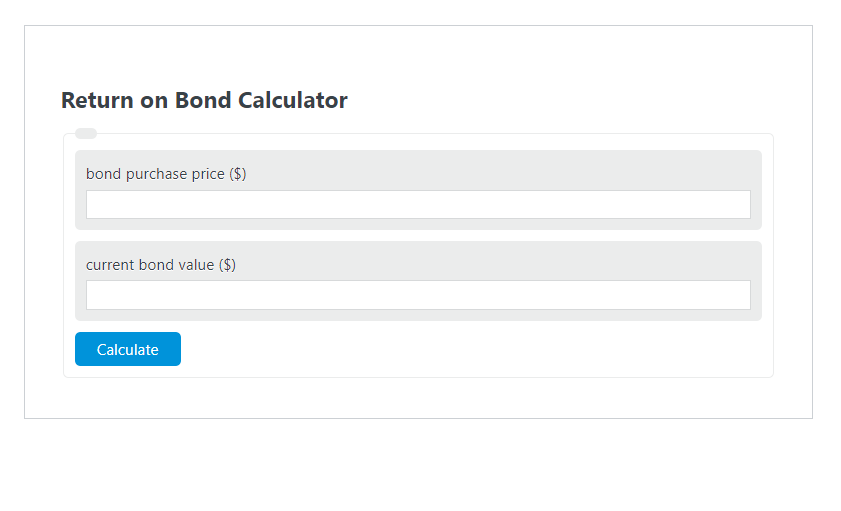

Enter the bond purchase price ($) and the current bond value ($) into the Return on Bond Calculator. The calculator will evaluate and display the Return on Bond.

- Return on “X” Calculators

- Average Return on Stocks Calculator

- Return On Invested Capital Calculator

- Return on Mutual Fund Calculator

Return on Bond Formula

The following formula is used to calculate the Return on Bond.

ROB = (CV-PP) / PP * 100

- Where ROB is the Return on Bond (%)

- CV is the bond purchase price ($)

- PP is the current bond value ($)

To calculate the return on bond, divide the bond profit by the bond purchase price, then multiply by 100.

How to Calculate Return on Bond?

The following example problems outline how to calculate Return on Bond.

Example Problem #1:

- First, determine the bond purchase price ($).

- The bond purchase price ($) is given as: 1500.

- Next, determine the current bond value ($).

- The current bond value ($) is provided as: 2500.

- Finally, calculate the Return on Bond using the equation above:

ROB = (CV-PP) / PP * 100

The values given above are inserted into the equation below and the solution is calculated:

ROB = (2500-1500) / 1500 * 100 = 66.66 (%)

FAQ

What factors can affect the Return on Bond (ROB)?

Several factors can influence the Return on Bond, including changes in interest rates, the credit rating of the issuer, market demand for bonds, inflation rates, and the time remaining until the bond’s maturity. A bond’s return is also affected by its coupon rate compared to current market rates.

How does the maturity period of a bond impact its return?

The maturity period of a bond can significantly impact its return. Generally, longer-term bonds carry more risk due to the uncertainty over a longer period, which can lead to higher returns compared to short-term bonds. However, this is not always the case, as market conditions and interest rates can change over time, affecting the bond’s value and return.

Can the Return on Bond (ROB) be negative?

Yes, the Return on Bond can be negative. This occurs when the current value of the bond is less than the purchase price, indicating a loss on the investment. Negative returns are more likely during periods of rising interest rates or if the bond issuer’s creditworthiness deteriorates.