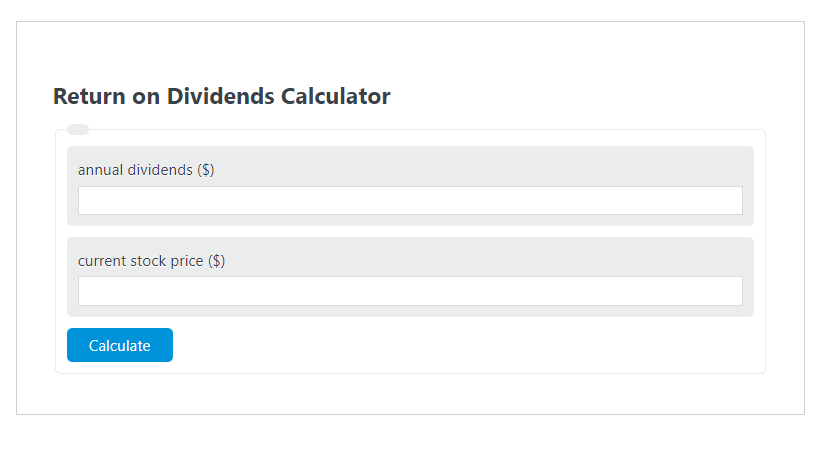

Enter the annual dividends ($) and the current stock price ($) into the Return on Dividends Calculator. The calculator will evaluate and display the Return on Dividends.

- Return on “X” Calculators

- Return on Net Worth Calculator

- Return on ETF Calculator

- Dividends Per Share Calculator

Return on Dividends Formula

The following formula is used to calculate the Return on Dividends.

ROD = AD / SP * 100

- Where ROD is the Return on Dividends (%)

- AD is the annual dividends ($)

- SP is the current stock price ($)

How to Calculate Return on Dividends?

The following example problems outline how to calculate Return on Dividends.

Example Problem #1:

- First, determine the annual dividends ($).

- The annual dividends ($) is given as: 50.

- Next, determine the current stock price ($).

- The current stock price ($) is provided as: 200.

- Finally, calculate the Return on Dividends using the equation above:

ROD = AD / SP * 100

The values given above are inserted into the equation below and the solution is calculated:

ROD = 50 / 200 * 100 = 25.00 (%)

FAQ

What is the significance of calculating Return on Dividends (ROD)?

Calculating the Return on Dividends (ROD) helps investors understand the dividend yield they are getting from their investments relative to the stock price. It’s a measure of how much dividend income has been returned per dollar invested in the stock, which can be a critical factor in assessing the attractiveness of dividend-paying stocks.

How can the Return on Dividends impact investment decisions?

The Return on Dividends can significantly impact investment decisions by highlighting the efficiency of dividend payouts relative to the stock’s current price. A higher ROD indicates a more attractive dividend yield, potentially making the stock more appealing to investors seeking income through dividends. Conversely, a lower ROD might signal that the stock is less efficient in generating income for investors.

Are there any limitations to using the Return on Dividends formula for investment analysis?

Yes, while the Return on Dividends formula provides a quick snapshot of dividend efficiency, it doesn’t account for other important factors such as the company’s growth potential, market conditions, or the sustainability of dividend payments. Therefore, it should be used in conjunction with other financial analyses and considerations when making investment decisions.