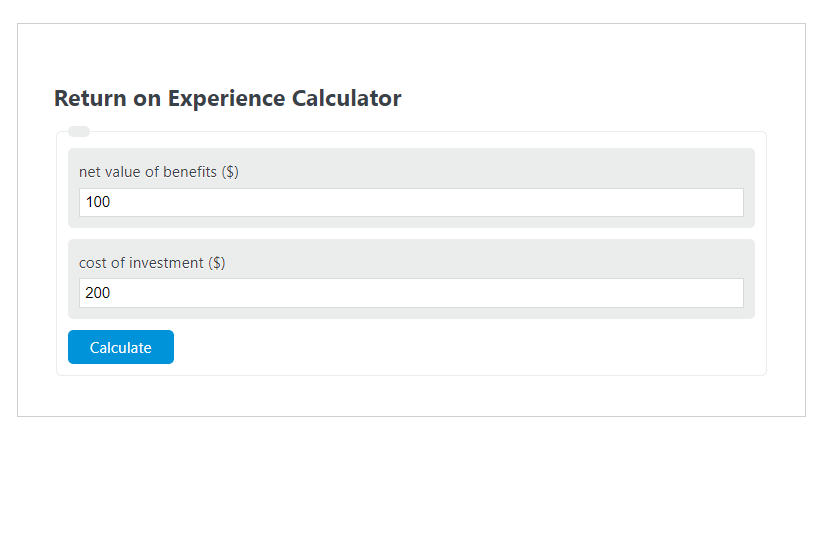

Enter the net value of benefits ($) and the cost of investment ($) into the Return on Experience Calculator. The calculator will evaluate and display the Return on Experience.

- Return on “X” Calculators

- Return on Value Calculator

- Return on Profit Calculator

- Return on Dividends Calculator

Return on Experience Formula

The following formula is used to calculate the Return on Experience.

ROX = NVB / CI * 100

- Where ROX is the Return on Experience (%)

- NVB is the net value of benefits ($)

- CI is the cost of investment ($)

To calculate the return on experience, divide the net value of benefits by the cost of investment, then multiply by 100.

How to Calculate Return on Experience?

The following example problems outline how to calculate Return on Experience.

Example Problem #1:

- First, determine the net value of benefits ($).

- The net value of benefits ($) is given as: 6,000.

- Next, determine the cost of investment ($).

- The cost of investment ($) is provided as: 10,000.

- Finally, calculate the Return on Experience using the equation above:

ROX = NVB / CI * 100

The values given above are inserted into the equation below and the solution is calculated:

ROX = 6,000 / 10,000 * 100 = 60.00 (%)

FAQ

What is Return on Experience (ROX)?

Return on Experience (ROX) is a metric used to measure the efficiency and effectiveness of an investment in terms of the experiences it generates. It calculates the percentage return by dividing the net value of benefits gained from an experience by the cost of investment in that experience, then multiplying by 100.

Why is calculating ROX important?

Calculating ROX is important because it helps businesses and individuals understand the value generated from their investments beyond traditional financial metrics. It emphasizes the importance of customer and user experiences, which can lead to increased loyalty, better brand reputation, and ultimately, higher revenues.

Can ROX be applied to all types of investments?

While ROX is particularly relevant for investments focused on enhancing customer or user experiences, such as in marketing campaigns, service improvements, or product design, its applicability can vary. For investments primarily aimed at financial return or operational efficiency, traditional return on investment (ROI) metrics might be more appropriate. However, considering ROX can provide additional insights into the broader impacts of various investments.