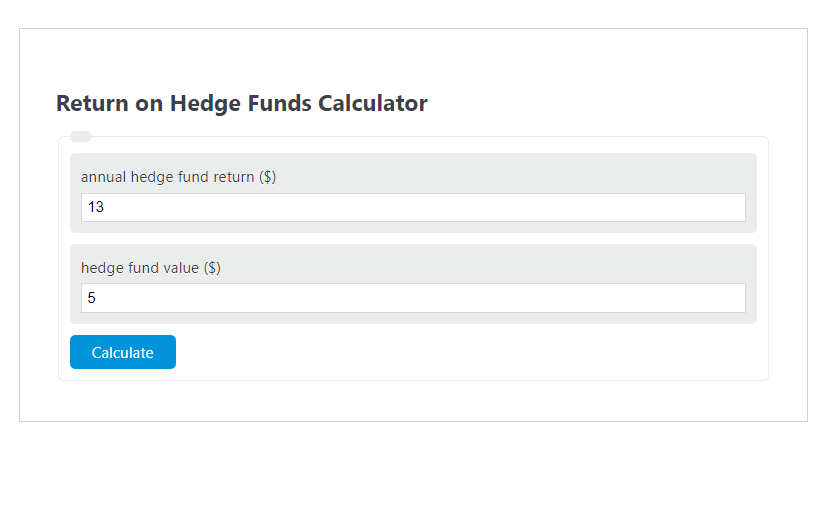

Enter the annual hedge fund return ($) and the hedge fund value ($) into the Return on Hedge Fund Calculator. The calculator will evaluate and display the Return on Hedge Fund.

- Return on “X” Calculators

- Return on Common Equity Calculator

- Return on REIT Calculator

- Return on Stocks Calculator

Return on Hedge Fund Formula

The following formula is used to calculate the Return on Hedge Fund.

ROHF = AR / FV * 100

- Where ROHF is the Return on Hedge Fund (%)

- AR is the annual hedge fund return ($)

- FV is the hedge fund value ($)

How to Calculate Return on Hedge Fund?

The following example problems outline how to calculate Return on Hedge Fund.

Example Problem #1:

- First, determine the annual hedge fund return ($).

- The annual hedge fund return ($) is given as: 5,000,000.

- Next, determine the hedge fund value ($).

- The hedge fund value ($) is provided as: 50,000,000.

- Finally, calculate the Return on Hedge Fund using the equation above:

ROHF = AR / FV * 100

The values given above are inserted into the equation below and the solution is calculated:

ROHF = 5,000,000 / 50,000,000 * 100 = 50.00 (%)

FAQ

What factors can affect the Return on Hedge Fund (ROHF)?

Several factors can influence the ROHF, including the hedge fund’s investment strategy, market volatility, the skill of the fund manager, and external economic conditions. Changes in these factors can lead to fluctuations in both the annual hedge fund return and the overall value of the hedge fund.

How does the size of the hedge fund impact its returns?

The size of a hedge fund can impact its returns in various ways. Larger funds may have access to more investment opportunities and can diversify their holdings more effectively, potentially leading to more stable returns. However, they may also face challenges in achieving high returns on large capital bases. Conversely, smaller hedge funds may be more agile and able to capitalize on niche opportunities, but they might also be more susceptible to significant losses.

Are there any risks associated with calculating and relying on the Return on Hedge Fund?

Yes, while calculating the ROHF provides valuable insights into the performance of a hedge fund, it also comes with risks. These include the risk of over-reliance on past performance as an indicator of future results, misunderstanding the impact of fees and expenses on returns, and the potential for market conditions to change, affecting the applicability of historical returns. Investors should consider these factors and conduct comprehensive due diligence before making investment decisions.