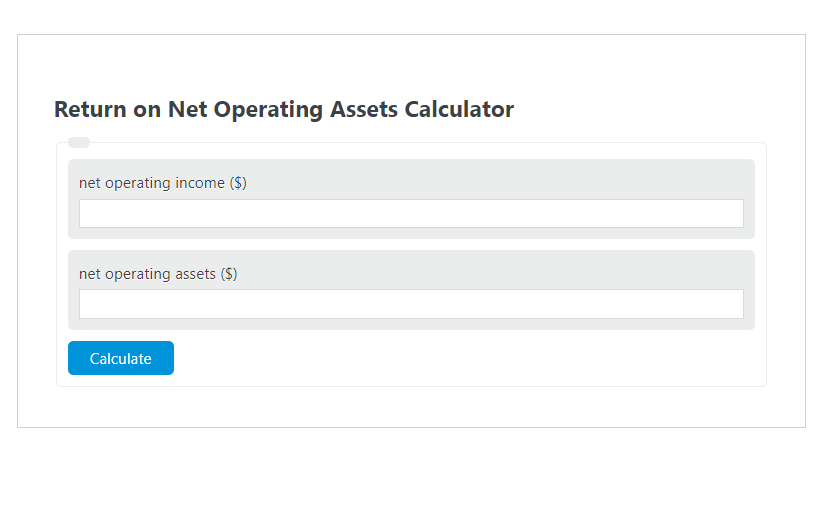

Enter the net operating income ($) and the net operating assets ($) into the Return on Net Operating Assets Calculator. The calculator will evaluate and display the Return on Net Operating Assets.

- Return on “X” Calculators

- Operating Margin Calculator

- Return on Gold Calculator

- Return on Revenue Calculator

Return on Net Operating Assets Formula

The following formula is used to calculate the Return on Net Operating Assets.

RONOA = NOI / NOA * 100

- Where RONOA is the Return on Net Operating Assets (%)

- NOI is the net operating income ($)

- NOA is the net operating assets ($)

How to Calculate Return on Net Operating Assets?

The following example problems outline how to calculate Return on Net Operating Assets.

Example Problem #1:

- First, determine the net operating income ($).

- The net operating income ($) is given as: 25,000.

- Next, determine the net operating assets ($).

- The net operating assets ($) is provided as: 100,000.

- Finally, calculate the Return on Net Operating Assets using the equation above:

RONOA = NOI / NOA * 100

The values given above are inserted into the equation below and the solution is calculated:

RONOA = 25,000 / 100,000 * 100 = 25 (%)

FAQ

What is Net Operating Income (NOI)?

NOI refers to the profit a company generates from its normal business operations, after subtracting all operating expenses except taxes and interest charges. It’s a measure of a company’s operational efficiency and is used in the calculation of RONOA.

Why is Return on Net Operating Assets (RONOA) important?

RONOA is a key financial metric that helps investors and analysts understand how effectively a company is using its assets to generate earnings from its core business operations. A higher RONOA indicates more efficient use of the company’s assets in generating net operating income.

How can improving RONOA benefit a company?

Improving RONOA can benefit a company by indicating better operational efficiency and profitability from its core business activities. This can attract more investors, lead to a higher stock price, and provide more reinvestment opportunities for the company to grow its operations further.