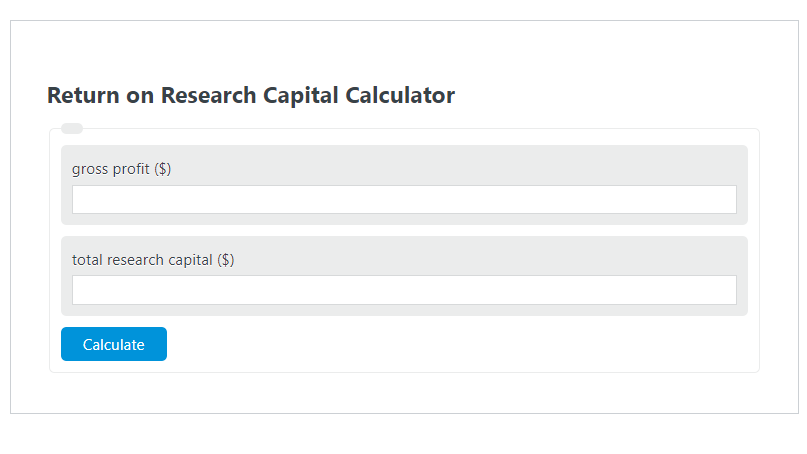

Enter the gross profit ($) and the total research capital ($) into the Return on Research Capital Calculator. The calculator will evaluate and display the Return on Research Capital.

- Return on “X” Calculators

- Return on Effort Calculator

- Return on Options Calculator

- Return on Management Calculator

Return on Research Capital Formula

The following formula is used to calculate the Return on Research Capital.

RORC = GP / RC

- Where RORC is the Return on Research Capital (.)

- GP is the gross profit ($)

- RC is the total research capital ($)

How to Calculate Return on Research Capital?

The following example problems outline how to calculate Return on Research Capital.

Example Problem #1:

- First, determine the gross profit ($).

- The gross profit ($) is given as: 100,000.

- Next, determine the total research capital ($).

- The total research capital ($) is provided as: 10,000.

- Finally, calculate the Return on Research Capital using the equation above:

RORC = GP / RC

The values given above are inserted into the equation below and the solution is calculated:

RORC = 100,000 / 10,000 = 10.00

FAQ

What is the importance of calculating Return on Research Capital (RORC)?

Calculating RORC is crucial for businesses as it helps measure the efficiency and effectiveness of the capital invested in research and development (R&D). This metric can guide companies in making informed decisions about allocating resources towards R&D, ensuring that investments are generating sufficient returns.

How can a company improve its Return on Research Capital?

A company can improve its RORC by increasing its gross profit without a proportional increase in research capital, or by making more strategic investments in research that lead to higher gross profits. This can involve optimizing R&D processes, focusing on high-impact research projects, and leveraging innovations to enhance product offerings and market competitiveness.

Are there any limitations to using the Return on Research Capital metric?

Yes, one limitation of the RORC metric is that it focuses solely on financial returns from research capital, potentially overlooking the qualitative benefits of R&D, such as innovation, technological advancement, and long-term strategic positioning. Additionally, RORC may not fully capture the delayed returns of R&D investments, as these can take years to materialize.