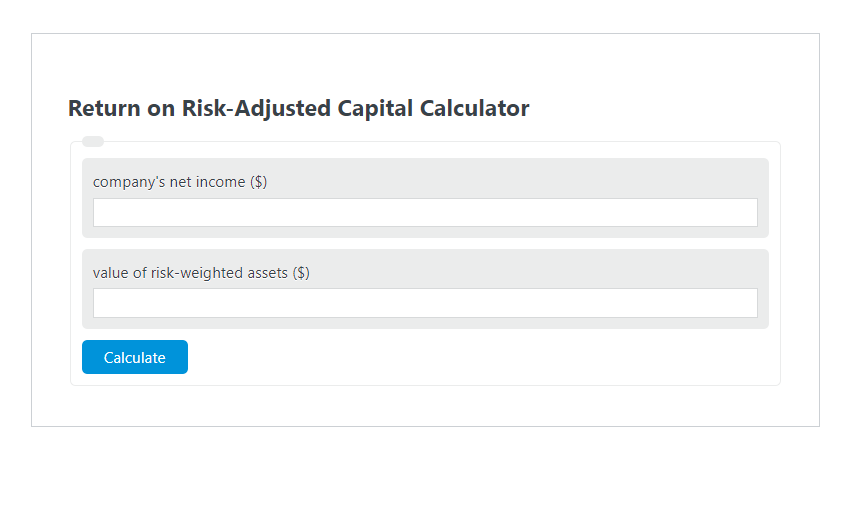

Enter the company’s net income ($) and the value of risk-weighted assets ($) into the Return on Risk-Adjusted Capital Calculator. The calculator will evaluate and display the Return on Risk-Adjusted Capital.

- Return on “X” Calculators

- Risk-Adjusted Return Calculator

- Return on Annuity Calculator

- Return on Investment Ratio Calculator

Return on Risk-Adjusted Capital Formula

The following formula is used to calculate the Return on Risk-Adjusted Capital.

RORAC = NI / RA * 100

- Where RORAC is the Return on Risk-Adjusted Capital (%)

- NI is the company’s net income ($)

- RA is the value of risk-weighted assets ($)

To calculate the return on risk-adjusted capital, divide the net income by the value of the risk-weighted assets, then multiply by 100.

How to Calculate Return on Risk-Adjusted Capital?

The following example problems outline how to calculate Return on Risk-Adjusted Capital.

Example Problem #1:

- First, determine the company’s net income ($).

- The company’s net income ($) is given as: 1780.

- Next, determine the value of risk-weighted assets ($).

- The value of risk-weighted assets ($) is provided as: 15,000.

- Finally, calculate the Return on Risk-Adjusted Capital using the equation above:

RORAC = NI / RA * 100

The values given above are inserted into the equation below and the solution is calculated:

RORAC = 1780 / 15,000 * 100 = 11.866 (%)

FAQ

What is the significance of using risk-weighted assets in calculating Return on Risk-Adjusted Capital (RORAC)?

Risk-weighted assets are used in the calculation of RORAC to account for the varying levels of risk associated with different assets. By adjusting for risk, RORAC provides a more accurate measure of a company’s profitability and efficiency in managing its capital under risk.

How can RORAC help in financial decision-making?

RORAC is a valuable metric for financial decision-making as it helps in assessing the profitability of investments or projects adjusted for their risk. It enables investors and managers to compare the performance of different investments, considering not just the returns but also the risks involved, thereby facilitating more informed and risk-aware decisions.

Can RORAC be applied to personal finance?

While RORAC is primarily used in corporate finance and investment banking to evaluate the performance of investments in relation to their risk, the concept can be adapted for personal finance. Individuals can use a similar approach to assess the risk-adjusted performance of their investment portfolios, helping them make better investment choices by considering both returns and risks.