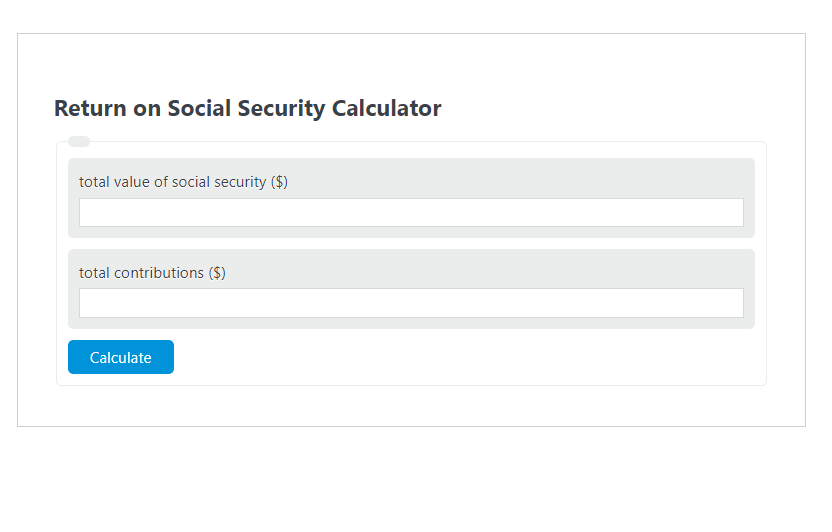

Enter the total value of social security ($) and the total contributions ($) into the Return on Social Security Calculator. The calculator will evaluate and display the Return on Social Security.

- Return on “X” Calculators

- Return on Experience Calculator

- Return on Value Calculator

- Return on Profit Calculator

Return on Social Security Formula

The following formula is used to calculate the Return on Social Security.

ROSS = (TV - C) / C * 100

- Where ROSS is the Return on Social Security (%)

- TV is the total value of social security ($)

- C is the total contributions ($)

How to Calculate Return on Social Security?

The following example problems outline how to calculate Return on Social Security.

Example Problem #1:

- First, determine the total value of social security ($).

- The total value of social security ($) is given as: 1,000,000.

- Next, determine the total contributions ($).

- The total contributions ($) is provided as: 450,000.

- Finally, calculate the Return on Social Security using the equation above:

ROSS = (TV – C) / C * 100 = (%)

The values given above are inserted into the equation below and the solution is calculated:

ROSS = (1,000,000 – 450,000) / 450,000 * 100 = 122.22%

FAQ

What factors can affect the total value of social security?

The total value of social security can be affected by several factors including the amount of time an individual has worked, their earnings over their career, the age at which they start receiving benefits, and any cost-of-living adjustments applied to their benefits.

How can one maximize their return on social security contributions?

Maximizing the return on social security contributions can be achieved by working for at least 35 years to ensure the highest earning years are counted, delaying the start of social security benefits up to age 70 to receive increased monthly payments, and regularly checking one’s social security statement for accuracy.

Are social security contributions mandatory for all employees?

Yes, social security contributions are mandatory for most employees in the United States. Both employees and employers are required to contribute to social security through payroll taxes. However, certain types of employment, such as some government positions or religious groups, may be exempt from mandatory contributions.