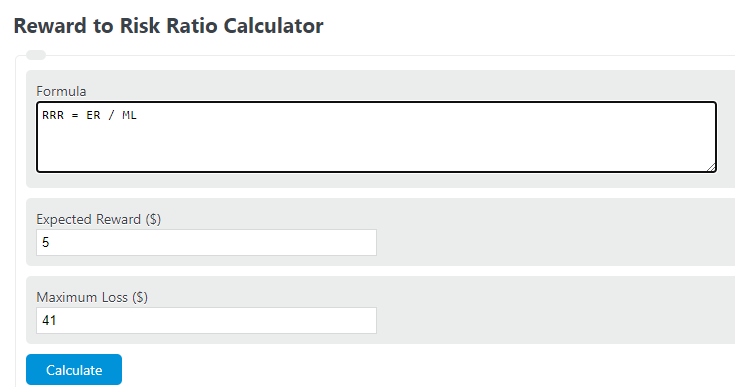

Enter the expected monetary return and the maximum possible loss into the calculator to determine the reward-to-risk ratio.

Reward to Risk Ratio Formula

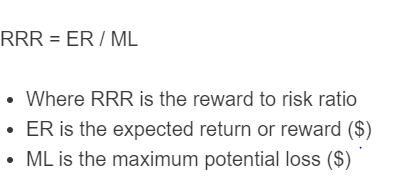

The following formula is used to calculate a reward-to-risk ratio.

RRR = ER / ML

RRR = ER / ML

- Where RRR is the reward-to-risk ratio

- ER is the expected return or reward ($)

- ML is the maximum potential loss ($)

Reward to Risk Ratio Definition

The Reward to Risk Ratio is a crucial metric used in financial analysis to assess the potential profitability of an investment relative to its associated risks. It provides a quantitative measure of the potential gain an investor can expect from an investment compared to the risk of losing their invested capital.

In simple terms, the Reward to Risk Ratio compares the potential reward or profit of an investment to the potential risk or loss. It is calculated by dividing the expected reward by the expected risk. A higher ratio indicates that the potential reward is greater than the potential risk, making the investment more attractive.

This ratio is important because it helps investors evaluate an investment worth pursuing. By considering the potential returns against the potential losses, investors can make informed decisions about whether to proceed with an investment opportunity.

A higher Reward to Risk Ratio implies that the potential reward outweighs the potential risk, making an investment more favorable. It suggests that the potential gain from the investment is relatively higher compared to the potential loss, providing a better chance for profitability. Consequently, investments with higher ratios are generally considered more desirable.

Conversely, a lower Reward to Risk Ratio indicates that the potential reward is relatively lower compared to the potential risk, making the investment less attractive. This suggests that the investment may carry a higher chance of incurring losses, reducing its overall appeal.

Reward to Risk Ratio Example

How to calculate reward to risk ratio?

- First, determine the potential or expected return.

This can either be the maximum expected monetary gain, or the most likely expected return.

- Next, determine the potential maximum loss.

For example, if you had a 50$ investment, the maximum loss is likely 50$.

- Finally, calculate the reward to risk ratio.

Calculate the RRR using the equation above.

FAQ

How is the Reward to Risk Ratio used in investment decisions?

The Reward to Risk Ratio is used by investors to assess the potential profitability of an investment in comparison to its risks. A higher ratio suggests that the expected reward outweighs the risk, making the investment more attractive. This helps investors make informed decisions on whether an investment is worth pursuing based on their risk tolerance.

Can the Reward to Risk Ratio predict the success of an investment?

While the Reward to Risk Ratio provides a quantitative measure of an investment’s potential profitability relative to its risks, it does not guarantee success. It is one of many tools investors use to evaluate investments. Market conditions, economic factors, and unexpected events can also impact the outcome of an investment.

Why is a higher Reward to Risk Ratio considered more favorable?

A higher Reward to Risk Ratio indicates that the potential gains from an investment significantly exceed the potential losses. This suggests that the investment offers a better chance of profitability, making it more favorable to investors who seek to maximize returns while minimizing risks.

Is it possible to have a negative Reward to Risk Ratio?

A negative Reward to Risk Ratio would imply that the potential losses exceed the potential gains, which is theoretically possible but highly unlikely in practice. Typically, investments are sought with the expectation of a positive return, and a negative ratio would deter investment. However, calculating the ratio accurately requires realistic estimates of both potential reward and risk.