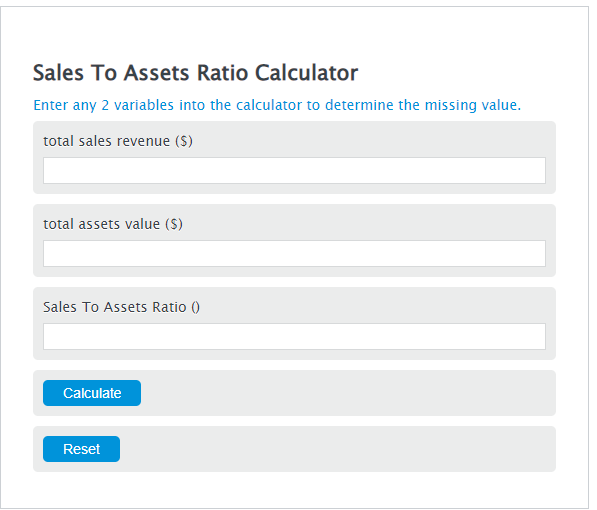

Enter the total sales revenue ($) and the total assets value ($) into the Calculator. The calculator will evaluate the Sales To Assets Ratio.

- Sales To Market Value Ratio Calculator

- Sales To Net Working Capital Ratio Calculator

- Sales Quantity Variance Calculator

Sales To Assets Ratio Formula

SAR = S/A

Variables:

- SAR is the Sales To Assets Ratio ()

- S is the total sales revenue ($)

- A is the total assets value ($)

To calculate Sales To Assets Ratio, divide the total sales revenue by the total asset value.

How to Calculate Sales To Assets Ratio?

The following steps outline how to calculate the Sales To Assets Ratio.

- First, determine the total sales revenue ($).

- Next, determine the total assets value ($).

- Next, gather the formula from above = SAR = S/A.

- Finally, calculate the Sales To Assets Ratio.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

total sales revenue ($) = 40

total assets value ($) = 1230

Frequently Asked Questions

What is the significance of the Sales To Assets Ratio?

The Sales To Assets Ratio is a financial metric used to evaluate a company’s efficiency in using its assets to generate sales revenue. A higher ratio indicates better performance in converting assets into sales, which can be a sign of operational efficiency and profitability.

How can the Sales To Assets Ratio impact business decisions?

Businesses use the Sales To Assets Ratio to make strategic decisions regarding asset management, investment, and operational improvements. A low ratio may prompt a review of asset utilization or encourage strategies to boost sales revenue without proportionately increasing asset base.

Can the Sales To Assets Ratio vary by industry?

Yes, the Sales To Assets Ratio can significantly vary by industry due to differences in business models, capital intensity, and operational practices. Therefore, it’s most useful to compare this ratio within the same industry for benchmarking performance.

What are common pitfalls when interpreting the Sales To Assets Ratio?

Common pitfalls include not considering industry-specific factors, ignoring the quality and age of assets, and focusing solely on this ratio without considering other financial metrics. It’s important to use the Sales To Assets Ratio as part of a broader financial analysis to gain a comprehensive understanding of a company’s performance.