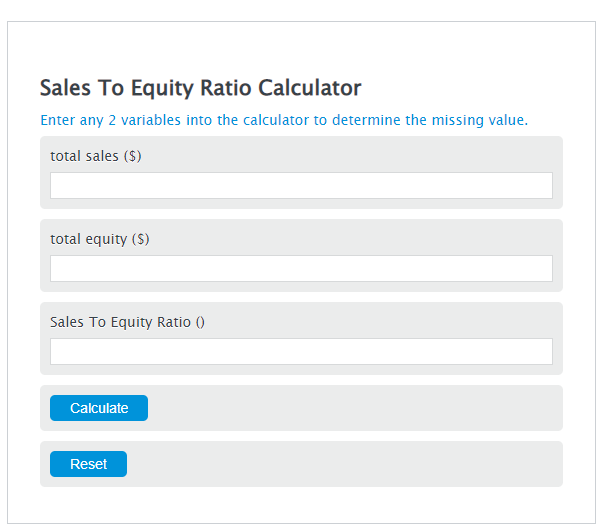

Enter the total sales ($) and the total equity ($) into the Calculator. The calculator will evaluate the Sales To Equity Ratio.

- Sales To Assets Ratio Calculator

- Sales To Market Value Ratio Calculator

- Sales To Net Working Capital Ratio Calculator

Sales To Equity Ratio Formula

SER = S/E

Variables:

- SER is the Sales To Equity Ratio ()

- S is the total sales ($)

- E is the total equity ($)

To calculate Sales To Equity Ratio, divide the sales revenue ($) by the total equity value ($).

How to Calculate Sales To Equity Ratio?

The following steps outline how to calculate the Sales To Equity Ratio.

- First, determine the total sales ($).

- Next, determine the total equity ($).

- Next, gather the formula from above = SER = S/E.

- Finally, calculate the Sales To Equity Ratio.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

total sales ($) = 570

total equity ($) = 900

Frequently Asked Questions

What is the significance of the Sales To Equity Ratio in financial analysis?

The Sales To Equity Ratio is a key financial metric that helps investors and analysts understand how effectively a company is utilizing its equity to generate sales. A higher ratio indicates that the company is efficiently using its equity base to drive sales, which can be a sign of good management and operational efficiency.

How can the Sales To Equity Ratio impact a company’s investment attractiveness?

A higher Sales To Equity Ratio can make a company more attractive to investors, as it suggests that the company is generating a good amount of sales relative to its equity. This can indicate a strong operational performance and potentially higher returns on equity investments. However, it’s important to consider this ratio in the context of other financial metrics and industry benchmarks.

Can the Sales To Equity Ratio vary significantly across different industries?

Yes, the Sales To Equity Ratio can vary widely across different industries due to varying capital structures and operational models. Industries that require less capital investment and have higher turnover rates may exhibit higher ratios, while capital-intensive industries might have lower ratios. It’s crucial to compare companies within the same industry for a meaningful analysis.

Are there any limitations to using the Sales To Equity Ratio as an analysis tool?

While the Sales To Equity Ratio can provide valuable insights into a company’s operational efficiency and use of equity, it has limitations. It does not account for debt and other liabilities, which can also impact a company’s financial health. Additionally, external factors such as market conditions and economic cycles can influence sales, affecting the ratio’s reliability as a sole measure of performance.