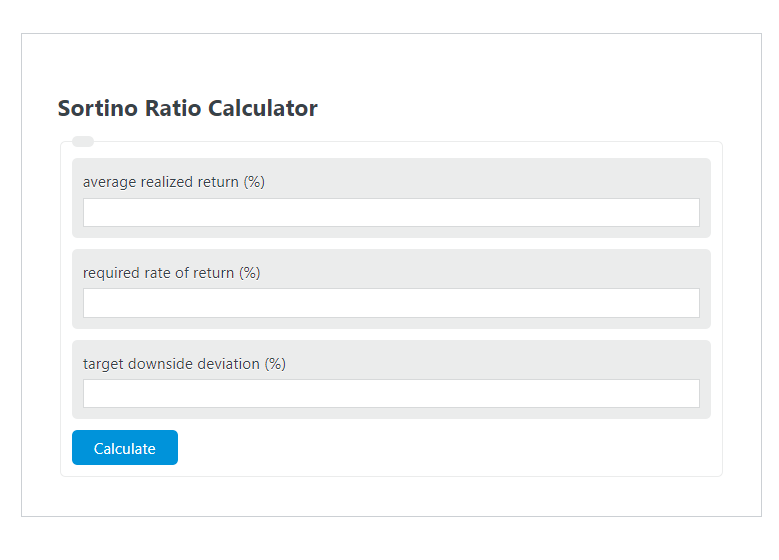

Enter the average realized return (%), the required rate of return (%), and the target downside deviation (%) into the Sortino Ratio Calculator. The calculator will evaluate and display the Sortino Ratio.

- All Ratio Calculators

- Leverage Ratio Calculator

- Benefit to Cost Ratio Calculator

- Debt Service Coverage Ratio Calculator

Sortino Ratio Formula

The following formula is used to calculate the Sortino Ratio.

SR = (AR - RR) / TD

- Where SR is the Sortino Ratio ( )

- AR is the average realized return (%)

- RR is the required rate of return (%)

- TD is the target downside deviation (%)

To calculate the Sortino ratio, subtract the required rate of return from the average realized return, then divide by the target downside deviation.

How to Calculate Sortino Ratio?

The following example problems outline how to calculate Sortino Ratio.

Example Problem #1

- First, determine the average realized return (%).

- The average realized return (%) is calculated to be : 30.

- Next, determine the required rate of return (%).

- The required rate of return (%) is measured to be: 20.

- Next, determine the target downside deviation (%).

- The target downside deviation (%) is found to be: 5.

- Finally, calculate the Sortino Ratio using the formula above:

SR = (AR – RR) / TD

The values given above are inserted into the equation below and the solution is calculated:

SR = (30 – 20) / 5 = 2.00

FAQ

What is the Sortino Ratio used for in investment analysis?

The Sortino Ratio is used to measure the risk-adjusted return of an investment asset, portfolio, or strategy. It differentiates harmful volatility from total overall volatility by using the target downside deviation instead of the total standard deviation of returns, focusing on the risk associated with negative returns.

How does the Sortino Ratio differ from the Sharpe Ratio?

While both the Sortino and Sharpe Ratios measure the risk-adjusted return of an investment, the key difference lies in how they define risk. The Sharpe Ratio considers the standard deviation of all returns as a measure of risk, whereas the Sortino Ratio only considers the downside deviation, or negative returns, as risk. This makes the Sortino Ratio potentially more useful for investors who are primarily concerned with downside risk.

Can the Sortino Ratio be negative? What does that indicate?

Yes, the Sortino Ratio can be negative. A negative Sortino Ratio indicates that the investment’s returns are less than the required rate of return, after adjusting for downside risk. This suggests that the investment is performing poorly in terms of risk-adjusted returns, particularly in terms of negative volatility, and may not be a desirable choice for risk-averse investors.