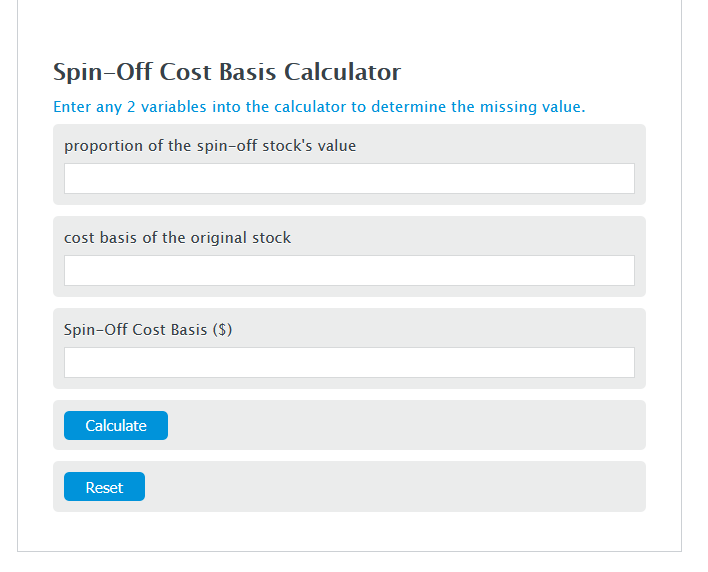

Enter the proportion of the spin-off stock's value and the cost basis of original stock into the Calculator. The calculator will evaluate the Spin-Off Cost Basis.

Spin-Off Cost Basis Formula

SOCB = PSV * OSV

Variables:

- SOCB is the Spin-Off Cost Basis ($)

- PSV is the proportion of the spin-off stock's value

- OSV is the cost basis of the original stock

To calculate Spin-Off Cost Basis, multiply the proportion of the spin-off stock's value by the cost basis of the original stock.

How to Calculate Spin-Off Cost Basis?

The following steps outline how to calculate the Spin-Off Cost Basis.

- First, determine the proportion of the spin-off stock's value.

- Next, determine the cost basis of original stock.

- Next, gather the formula from above = SOCB = PSV * OSV.

- Finally, calculate the Spin-Off Cost Basis.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

proportion of the spin-off stock's value = 0.45

cost basis of original stock = 30

Frequently Asked Questions

What is a spin-off in financial terms?

A spin-off occurs when a company divides parts of its business to create a new, independent company. Shareholders of the parent company receive equivalent shares of the new company, affecting their cost basis in the original investment.

How does a spin-off affect stock prices?

Initially, the stock price of the parent company may drop to reflect the value of the spun-off entity. However, both the parent and the new company's stocks may benefit in the long term from more focused business strategies and operations.

Why do companies decide to spin off parts of their business?

Companies may decide on a spin-off for several reasons, including focusing on core business operations, unlocking hidden shareholder value, or complying with regulatory requirements. It can also help the parent company and the spin-off to operate more efficiently.

What are the tax implications of a spin-off for investors?

Spin-offs can be structured to be tax-free for shareholders, meaning they don't have to pay taxes on the receipt of the new shares at the time of the spin-off. However, investors should consult with a tax advisor as the specifics can vary based on individual circumstances and the nature of the spin-off.