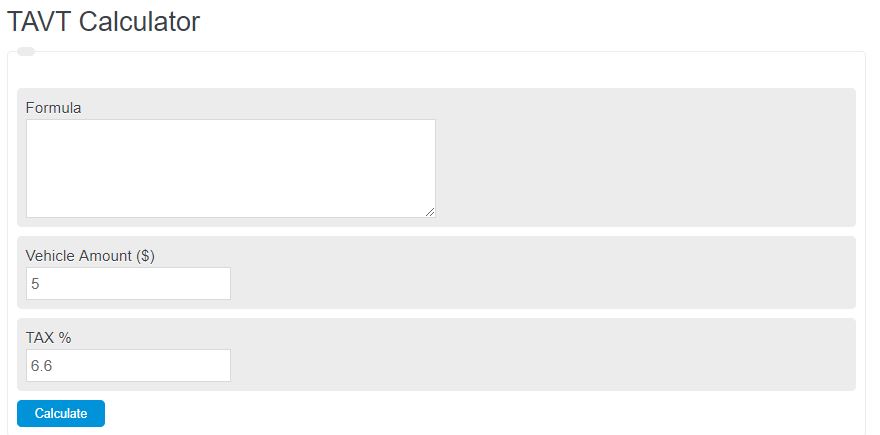

Enter the total value of your vehicle into the calculator to determine the total amount of TAVT tax owed when purchasing a car.

- Car Depreciation Calculator (% per year)

- Car Affordability Calculator

- LTV Calculator (Loan to Value %)

TAVT Formula

The following formula is used to calculate the TAVT tax owed.

TAVT = V * .066

- Where TAVT is the title ad valorem tax

- V is the vehicle purchase price

The vehicle purchase price refers to the amount of money paid to acquire a vehicle.

What is TAVT?

TAVT, or Title Ad Valorem Tax, is a type of taxation system implemented in certain states in the United States. It is an alternative to the traditional sales tax imposed on the purchase of motor vehicles.

Under the TAVT system, instead of paying sales tax at the time of purchase, vehicle owners are required to pay a one-time tax based on the value of the vehicle.

This tax is calculated as a percentage of the vehicle’s fair market value, and the rate can vary from state to state. The TAVT is typically collected by the state’s Department of Revenue or Motor Vehicle Division.

The primary purpose of TAVT is to simplify the tax collection process and provide a more efficient way to generate revenue for the state.

FAQ

What is the purpose of the TAVT system?

The Title Ad Valorem Tax (TAVT) system is designed to simplify the tax collection process on vehicle purchases, reducing the administrative burden on both the government and taxpayers. It aims to provide a more efficient way to generate revenue for the state by imposing a one-time tax based on the vehicle’s value.

How is the TAVT calculated?

The TAVT is calculated by multiplying the vehicle’s purchase price by a specific rate, which is currently set at 6.6% (0.066). This means if you purchase a vehicle, you will owe TAVT equal to 6.6% of the vehicle’s purchase price.

Does the TAVT rate vary from state to state?

Yes, the TAVT rate can vary from state to state. While the concept of TAVT is consistent, each state that implements this tax system may set its own rate based on the vehicle’s fair market value.

What advantages does TAVT offer over traditional sales tax models?

TAVT offers several advantages over traditional sales tax models, including a simplified tax collection process by eliminating the need for ongoing tax collection and reporting on vehicle purchases. It also has the potential to generate more revenue for the state, as the tax is based on the vehicle’s value, ensuring that higher-priced vehicles contribute more to the state’s revenue. This progressive tax structure is considered fairer, aligning with the principle that wealthier individuals should pay a higher proportion of taxes.