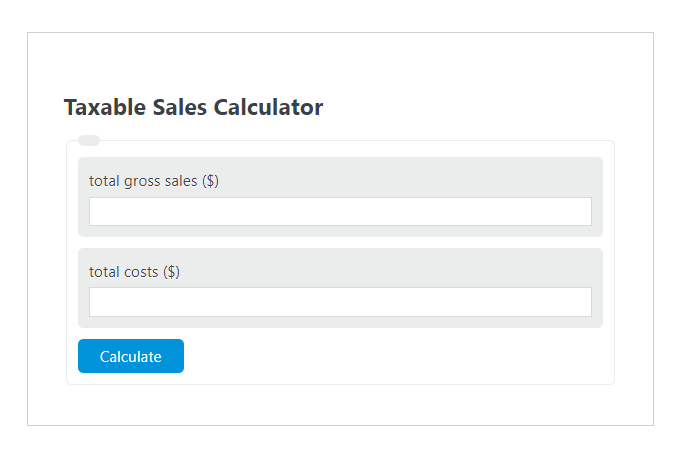

Enter the total gross sales ($) and the total costs ($) into the Taxable Sales Calculator. The calculator will evaluate and display the Taxable Sales.

- All Sales Calculators

- Annual Sales Calculator

- Business Sales Calculator

- Profit Margin On Sales Calculator

Taxable Sales Formula

The following formula is used to calculate the Taxable Sales.

TS = GS - C

- Where TS is the Taxable Sales ($)

- GS is the total gross sales ($)

- C is the total costs ($)

How to Calculate Taxable Sales?

The following example problems outline how to calculate Taxable Sales.

Example Problem #1:

- First, determine the total gross sales ($).

- The total gross sales ($) is given as: 40,000.

- Next, determine the total costs ($).

- The total costs ($) is provided as: 20,000.

- Finally, calculate the Taxable Sales using the equation above:

TS = GS – C

The values given above are inserted into the equation below:

TS = 40,000 – 20,000 = 20,000.00 ($)

FAQ

What factors can affect the total costs in the Taxable Sales formula?

Total costs can include a variety of expenses such as production costs, labor, materials, shipping, and overhead. Changes in these expenses can significantly affect the total costs, thereby impacting the taxable sales.

How can understanding taxable sales benefit a business?

Understanding taxable sales can help a business in budgeting and financial planning. It enables businesses to estimate the tax liabilities accurately, manage cash flow more effectively, and make informed decisions about pricing and discounts.

Are there any exceptions or special considerations when calculating taxable sales?

Yes, depending on the jurisdiction, certain items may be exempt from sales tax or taxed at a different rate. Additionally, returns, allowances, and discounts should be considered as they can lower the gross sales figure, thus affecting the taxable sales calculation.