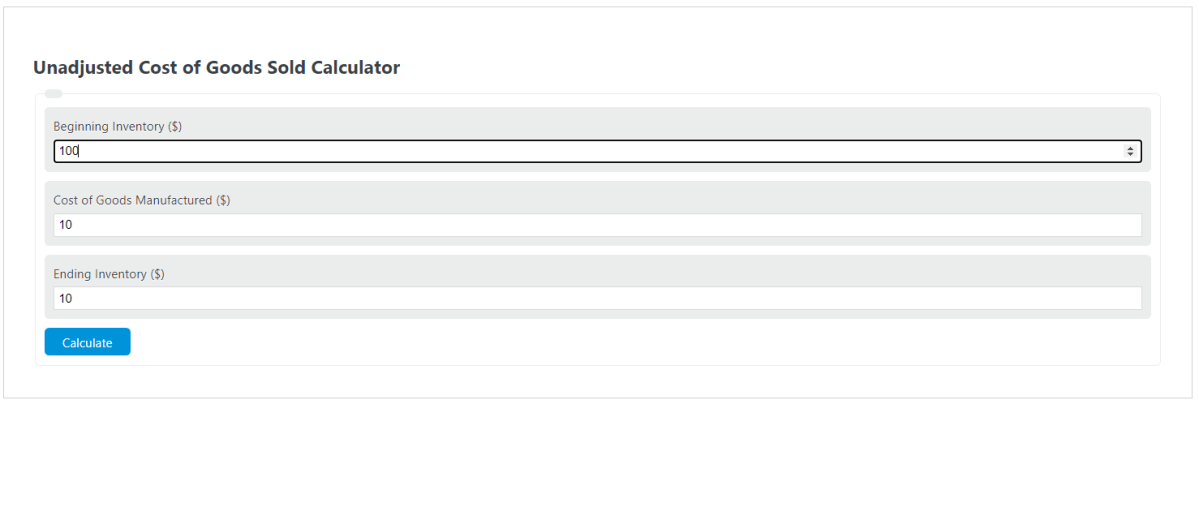

Enter the beginning inventory, cost of goods manufactured, and ending inventory into the calculator to determine the unadjusted cost of goods sold.

- Cost of Goods Manufactured Calculator (COGM)

- Cost of Goods Purchased Calculator

- Cost of Goods Sold Calculator

- Assessable Value Calculator

- Cost To Retail Ratio Calculator

Unadjusted Cost of Goods Sold Formula

The following formula is used to calculate the unadjusted cost of goods sold.

UACOGS = BI + COGM - EI

- Where UACOGS is the unadjusted cost of goods sold

- BI is the beginning inventory value ($)

- COGM is the cost of goods manufactured ($)

- EI is the ending inventory value ($)

To calculate unadjusted cost of goods sold, sum the beginning inventory value and the cost of goods manufactured, then subtract the ending inventory value.

What is an Unadjusted Cost of Goods Sold ?

Definition:

An Unadjusted Cost of Goods Sold is a measure of the cost of goods sold before any adjustments are made to account for overhead etc.

How to calcualte Unadjusted Cost of Goods Sold?

Example Problem:

The following example outlines how to calculate an Unadjusted Cost of Goods Sold.

First, determine the beginning inventory value. In this example, the beginning inventory is worth $100,000.00.

Next, determine the cost of goods manufactured. For this example, the COGM is found to be $30,000.00.

Next, determine the ending inventory. The ending inventory value is measured to be $50,000.00.

Finally, calculate the Unadjusted Cost of Goods Sold using the formula above:

UACOGS = BI + COGM – EI

UACOGS = 100000 + 30000 – 50000

UACOGS = $80,000.00