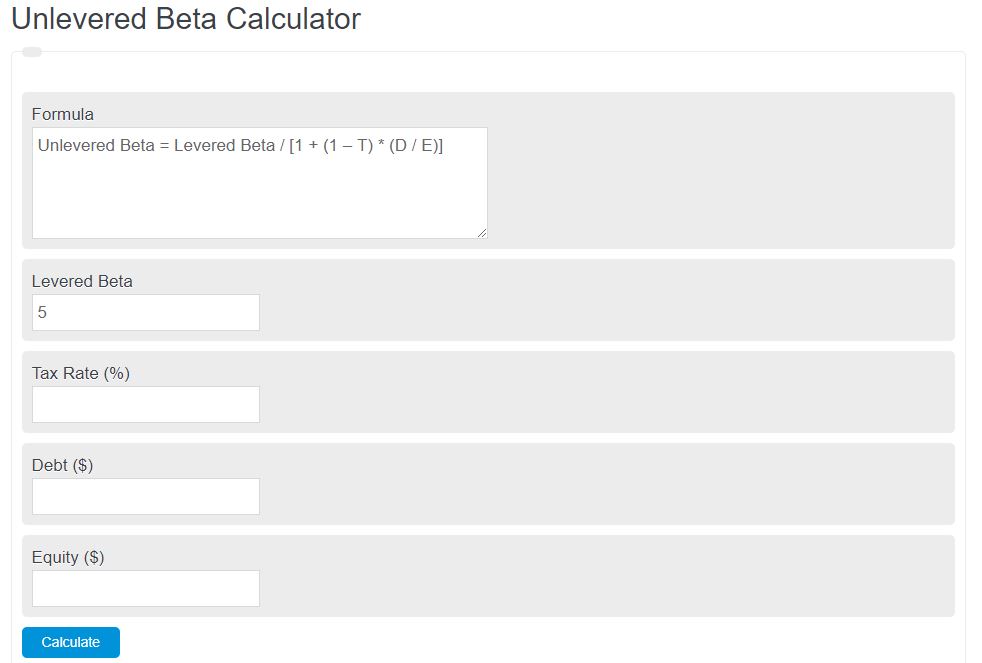

Enter the equity beta, tax rate, total equity, and total debt into the calculator. The calculator will evaluate the unlevered beta, also known as asset beta.

- Levered Beta Calculator

- Asset Turnover Ratio Calculator

- Equity Value Calculator

- Beta Portfolio Calculator

Unlevered Beta Formula

The following equation is used to calculate an unlevered or asset beta.

Unlevered Beta = Levered Beta / [ 1+(1-t)*(d/e)]

- Where t is the tax rate

- d is the total debt

- e is the total equity

Unlevered Beta Definition

Unlevered Beta is a financial metric that analyzes volatility with respect to the overall market. It does this using the levered beta, tax rate, and ratio of debt to equity. The ratio to debt to equity is the key value for this metric.

How to calculate unlevered beta?

- First, determine the levered beta.

Calculate the levered beta.

- Next, determine the tax rate.

Calculate the effective tax rate.

- Next, determine the total debt.

Calculate the total debt of the company.

- Next, measure the total equity.

Calculate the equity.

- Finally, calculate the unlevered beta.

Use the equation above to calculate the unlevered beta.

FAQ

Unlevered beta is a measure of volatility with respect to the entire market.