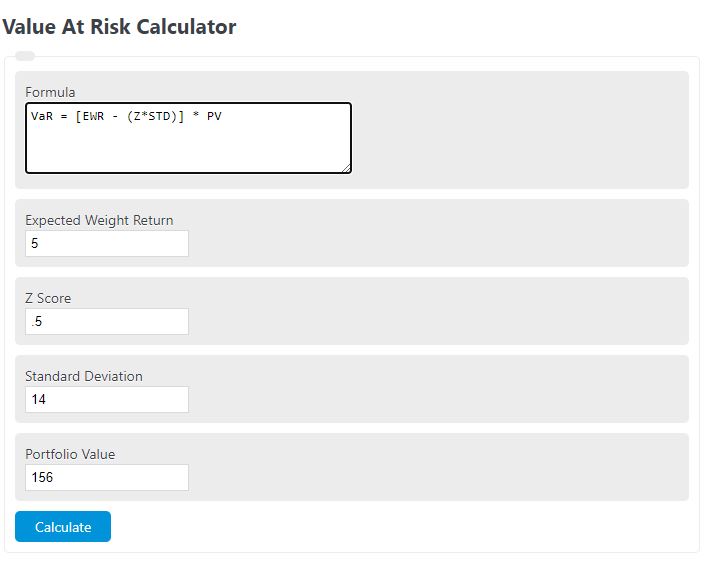

Enter the expected weighted return, z-score, standard deviation, and the total value of a portfolio to calculate the value at risk.

- Z-Score Calculator

- Confidence Interval Calculator (1 or 2 means)

- Relative Standard Deviation Calculator

- Variable Overhead Calculator

Value At Risk Formula

The following formula is used to calculate a value at risk.

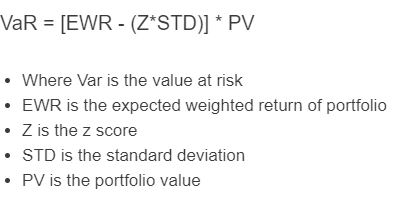

VaR = [EWR - (Z*STD)] * PV

- Where Var is the value at risk

- EWR is the expected weighted return of the portfolio

- Z is the z score

- STD is the standard deviation

- PV is the portfolio value

To calculate value at risk, multiply the standard deviation return by the z score, subtract this result from the expected weighted return, then finally multiply by the portfolio value.

Value At Risk Definition

A value at risk is defined as the likelihood of an investment portfolio exceeding a certain amount of monetary loss.

Value At Risk Example

How to calculate value at risk?

- First, determine the expected weighted return.

Calculate the expected return.

- Next, determine the z score and standard deviation.

Calculate the z score and standard deviation.

- Next, determine the portfolio value.

Calculate the portfolio value.

- Finally, calculate the value at risk.

Calculate the value at risk using the formula above.

FAQ

VAR stands for value at risk. It is a measure of the confidence or likelihood of a given portfolio exceeding a certain loss. In other words, t’s a minimum loss in dollars over a given period based on probability of past performance.