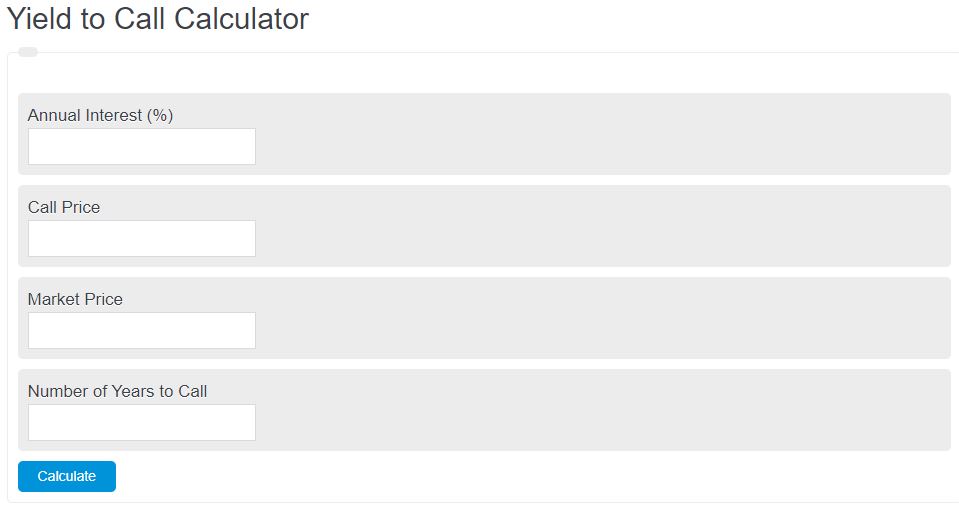

Enter the face value, bond price, years to maturity, call price, and years to call. The calculator will determine the yield to call %.

- Stock Calculator (Profit Calculator)

- Diluted Earnings Per Share Calculator (w/ Formula)

- Price/Earnings Ratio Calculator

- Earnings Per Share Calculator

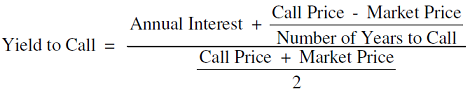

Yield to Call Formula

The following formula is used to calculate the yield-to-call ratio.

Yield To Call Definition

Yield to Call refers to the expected rate of return an investor will receive if they hold a callable bond until the issuer exercises its right to call or redeem the bond before its scheduled maturity date.

It is a crucial concept for bond investors as it helps them evaluate the potential return and risks associated with callable bonds.

When a bond is issued, it typically has a fixed interest rate and maturity date. However, some bonds come with a call provision that allows the issuer to repay the bond’s principal before the maturity date.

This usually occurs when interest rates decline, enabling the issuer to refinance the debt at a lower cost. When a bond is called, the bondholder receives the principal value of the bond, and the interest payments cease.

Yield to Call is important because it helps investors assess the attractiveness of a callable bond compared to non-callable bonds or other investment options.

By calculating the yield to call, investors can estimate their potential return if the bond is called at the earliest possible date. It is a valuable metric for comparing different bonds with varying call dates and call prices.

Investors typically aim to maximize their yield to call by selecting bonds that offer a favorable combination of coupon rate, call date, and call price. By assessing the yield to call, investors can evaluate the impact of potential call scenarios on their investment portfolio and make informed decisions.

Yield to Call Example

How to calculate yield to call?

- First, determine the annual interest.

Calculate the annual interest.

- Next, determine the call price and market price.

Calculate the call price and market price.

- Next, determine the number of years to call.

Determine the total years until the bond call date.

- Finally, calculate the yield to call ratio.

Calculate the yield to call using the equation above.

FAQ

Yield to call is a term used to describe the return a bondholder will see if a bond is held until its call date. The call date must occur sometime before the bond reaches maturity.

The call price in terms of yield to call is the price at which the bond can be purchased by two financial institutions.

The number of years is the length at which the bond can be purchased at the call price.