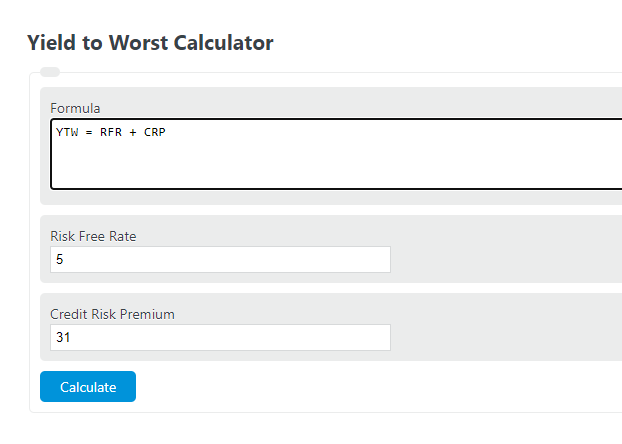

Enter the risk-free rate and the credit risk premium into the calculator to determine the yield to worst of a bond.

Yield to Worst Formula

The following equation can be used to calculate the yield to worst.

YTW = RFR + CRP

- Where YTW is the yield to worst

- RFR is the risk-free rate

- CRP is the credit risk premium

To calculate the yield to worst, sum the risk-free rate and the credit risk premium.

The risk-free rate refers to the hypothetical rate of return on an investment with no risk of default or loss.

The credit risk premium is the additional return demanded by investors for holding a risky debt instrument compared to a risk-free investment.

Yield to Worst Definition

A yield to worst is defined as the sum of the risk-free rate and the credit risk premium of a bond. It’s equal to the lower the yield-to-call and yield-to-maturity.

Yield to Worst Example

How to calculate yield to worst?

- First, determine the risk free rate.

Calculate or measure the risk free rate of the bond.

- Next, determine the credit risk premium.

Calculate or measure the credit risk premium associated with the bond.

- Finally, calculate the yield to worst.

Calculate the yield to worst using the equation above.

FAQ

What is the risk-free rate and how is it determined?

The risk-free rate is a theoretical return on an investment that carries no risk of financial loss. It is often represented by the yield on government securities, such as U.S. Treasury bonds, as these are considered free from the risk of default.

How does the credit risk premium affect bond pricing?

The credit risk premium is the extra yield that investors demand for taking on the additional risk of a bond that might default, compared to a risk-free bond. This premium makes riskier bonds yield more to compensate for their higher risk of default.

Can the yield to worst change over time?

Yes, the yield to worst can change over time due to fluctuations in the risk-free rate, changes in the credit risk premium, or both. These changes reflect the market’s evolving perception of risk and the economic environment.

Why is calculating the yield to worst important for investors?

Calculating the yield to worst is crucial for investors as it provides the lowest possible yield that can be received on a bond without the issuer defaulting. This metric helps investors assess the minimum expected return, aiding in more informed investment decisions.