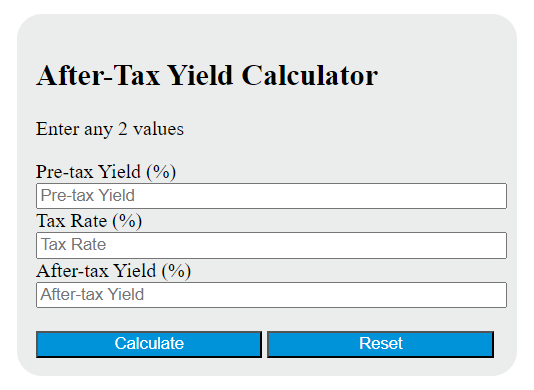

Enter the pre-tax yield or return on the investment and the investor’s marginal tax rate into the calculator to determine the after-tax yield. This calculator can also evaluate any of the variables given the others are known.

After-Tax Yield Formula

The following formula is used to calculate the after-tax yield.

ATY = (Yield * (1 - Tax Rate))

Variables:

- ATY is the after-tax yield

- Yield is the pre-tax yield or return on the investment

- Tax Rate is the investor’s marginal tax rate

To calculate the after-tax yield, multiply the pre-tax yield or return on the investment by the difference of 1 and the investor’s marginal tax rate.

What is a After-Tax Yield?

After-tax yield is a measure of return on an investment after all applicable taxes have been deducted. It is often used to compare the profitability of investments that have different tax implications. For example, municipal bonds are often tax-free, while corporate bonds are not. By calculating the after-tax yield, an investor can make a more accurate comparison of the potential returns from different types of investments.

How to Calculate After-Tax Yield?

The following steps outline how to calculate the After-Tax Yield.

- First, determine the pre-tax yield or return on the investment (Yield).

- Next, determine the investor’s marginal tax rate (Tax Rate).

- Next, gather the formula from above = ATY = Yield * (1 – Tax Rate).

- Finally, calculate the After-Tax Yield.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem :

Use the following variables as an example problem to test your knowledge.

Pre-tax yield or return on the investment (Yield) = 0.08

Investor’s marginal tax rate (Tax Rate) = 0.25