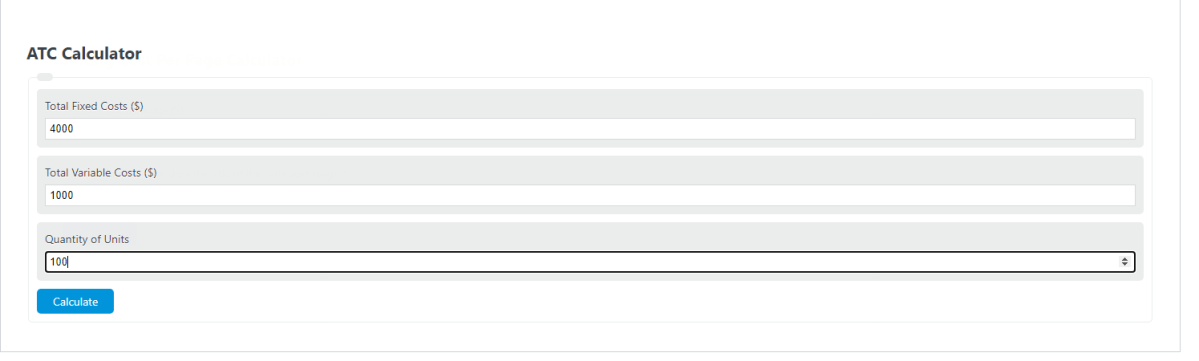

Enter the fixed costs, variable costs, and quantity of goods into the calculator to determine the average total cost.

- Average Cost Calculator

- Average Cost Basis Calculator

- Average Variable Cost Calculator

- Fixed Cost Calculator

- Variable Overhead Calculator

Average Total Cost Formula

The following formula is used to calculate an average total cost (ATC).

ATC = (FC / Q ) + (VC / Q)

- Where ATC is the average total cost

- FC is the total fixed costs

- VC is the total variable costs

- Q is the quantity of goods

To calculate the average total cost, divide the fixed costs by the quantity, then add this value to the result of the variable costs divided by the quantity.

Definition

What is atc?

ATC, short for the average total cost, is a measure of the sum of the fixed and variable costs per unit or quantity of goods.

The fixed costs in this case are costs that do not change based on quantity while the variable costs can change based on quantity and other factors. More on this is explored in the calculators linked above.

Example Problem

How to claculate atc?

The following example problem outlines the process for calculating an average variable cost of a product or good.

First, determine the total number of units that are produced. In this case, there were a total of 1,000 units produced in the lot.

Next, determine the total fixed costs associated with those goods. In this example, the fixed costs it took to produce the 1000 units is found to be $4,000.00.

Next, determine the total variable costs. In this problem, there was $1000.00 worth of variable costs.

Finally, calculate the ATC using the formula above:

ATC = (FC / Q ) + (VC / Q)

ATC = (4000 / 1000 ) + (1000/ 1000)

ATC = $5.00 average total cost per unit