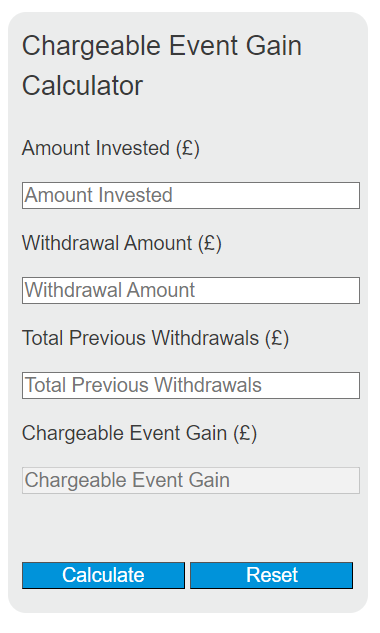

Enter the amount invested, the withdrawal amount, and any previous withdrawals into the calculator to determine the chargeable event gain. This calculator helps in assessing the taxable gain after a withdrawal from an investment bond.

Chargeable Event Gain Formula

The following formula is used to calculate the chargeable event gain:

CEG = WA - (AI - TPW) * (WA / AI)

Variables:

- CEG is the chargeable event gain (£)

- WA is the withdrawal amount (£)

- AI is the amount invested (£)

- TPW is the total previous withdrawals (£)

To calculate the chargeable event gain, subtract the product of the total previous withdrawals subtracted from the amount invested and the fraction of the withdrawal amount over the amount invested from the withdrawal amount.

What is a Chargeable Event Gain?

A chargeable event gain is the taxable profit realized after a withdrawal from an investment bond. It is the amount on which the investor may have to pay tax. This calculation is necessary for tax planning and compliance with tax regulations.

How to Calculate Chargeable Event Gain?

The following steps outline how to calculate the Chargeable Event Gain.

- First, determine the amount invested (AI) in the investment bond (£).

- Next, determine the withdrawal amount (WA) from the bond (£).

- Next, determine the total previous withdrawals (TPW) from the bond (£).

- Next, gather the formula from above = CEG = WA – (AI – TPW) * (WA / AI).

- Finally, calculate the Chargeable Event Gain (CEG) in pounds (£).

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Amount invested (AI) = £50,000

Withdrawal amount (WA) = £10,000

Total previous withdrawals (TPW) = £5,000