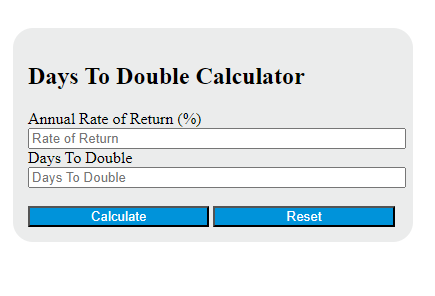

Enter the annual rate of return into the calculator to determine the Days To Double. This calculator can also evaluate any of the variables given the others are known.

Days To Double Formula

The following formula is used to calculate the Days To Double (DTD) for an investment.

DTD = 365 * (72 / r)

Variables:

- DTD is the estimated number of days it will take for an investment to double in value

- r is the annual rate of return (percentage)

To calculate the Days To Double, divide 72 by the annual rate of return. Multiply the result by 365 to convert the result from years to days. This will give an approximate number of days it will take for the investment to double, assuming a constant rate of return.

What is a Days To Double?

Days To Double is a financial metric that estimates the number of days it will take for an investment to double in value, given a particular rate of return. This is often calculated using the rule of 72, which involves dividing 72 by the annual rate of return. The result gives an approximate number of years it will take for the investment to double. This concept is commonly used in finance to understand the power of compound interest and to compare the potential returns of different investments.

How to Calculate Days To Double?

The following steps outline how to calculate the Days To Double using the given formula:

- First, determine the annual rate of return (r) as a percentage.

- Next, substitute the value of r into the formula: DTD = 365 * (72 / r).

- Finally, calculate the Days To Double.

- After inserting the variables and calculating the result, check your answer with the calculator above.

Example Problem:

Use the following variables as an example problem to test your knowledge.

Annual rate of return (r) = 8%

Substitute the value of r into the formula: DTD = 365 * (72 / 8).